But to the person who owes the money, the debt is an asset. Banks count loans as assets because they are valuable reserves.

Contents

Are loans payable debt?

Payable Loans Are Unlike Accounts Payable, Payable Loans You Must Pay. You take out debt with a cash loan, where accounts payable are debts due for goods or services.

Is a loan a disbursable asset? What is the Difference Between Payable Loans and Receivables? The difference between a loan payable and a loan receivable is that one is a liability of the company and the other is an asset.

Is loans payable a debit?

When you enter a loan payment in your account it will take into account the cost of interest and your loan to be paid and credit to your money. The lender’s record must match your loan account in Loan Payable.

What type of account is loan payable?

Payable debt is a credit report that shows the amount of any debt you’ve taken out that you haven’t paid back. The accounts receivable account lists the amount that the lender has paid to borrowers.

Is a payable a debit or credit?

As debts are added to credits, you will calculate accounts payable. And, you need to remove access by signing out from another account. When you pay the invoice, the amount owed to you decreases (accounts payable). As the debt is reduced by payments, you will pay off the accounts payable.

Is a loan a debt or liability?

Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred income, bonds, securities, and accrued expenses. Debt can be compared to assets. Debts are things you owe or have borrowed; Assets are things you own or are owed.

Is a loan an asset or liability?

Is a loan an asset? A loan is an asset but note that for reporting purposes, that loan will also be listed separately as a liability. Take a business bank loan for a bike. The company borrowed $15,000 and now owes $15,000 (plus possible bank fees, plus interest).

Is a loan a liability in accounting?

Liabilities are any debts your company has, whether they are bank loans, mortgages, unpaid bills, IOUs, or any other money you owe someone else. If you have promised to pay someone a sum of money in the future and have not yet paid, that is a liability.

What does loan payable mean?

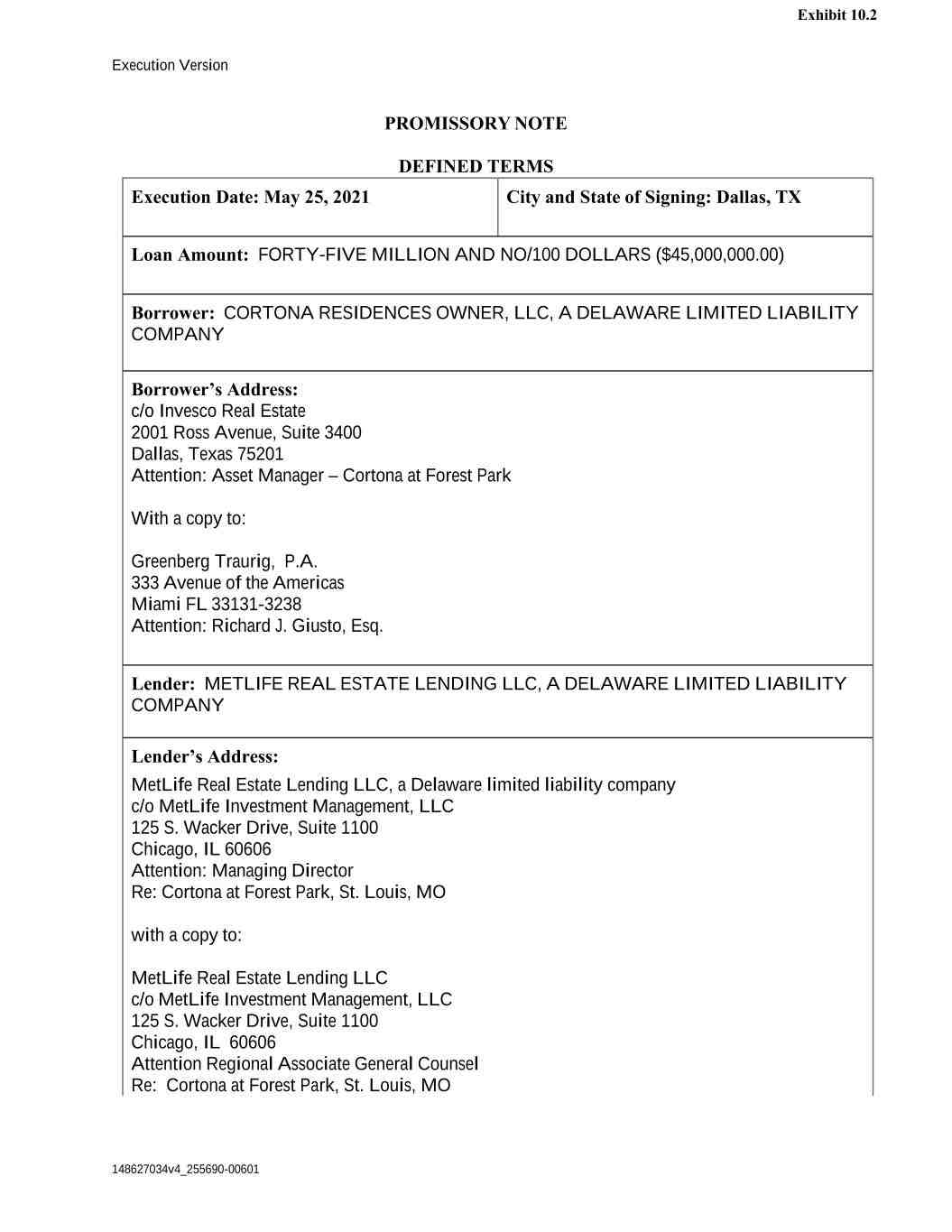

The loan is written on a promissory note. If part of the debt is still payable as of the company’s balance sheet date, the remaining balance of the debt is called payable debt.

Is loan payable a debit or credit?

Business credit recording Make a debit (increase) entry to cash, accounting for the credit as notes or accounts payable.

What is loan payable on a balance sheet?

A mortgage loan is a liability account that contains the total unpaid balance of the mortgage. The amount of this liability to be paid in the next 12 months is reported as a current liability on the balance sheet, while the remaining balance is reported as a long-term liability.

What account type is notes payable?

A note payable is classified on the balance sheet as a short-term liability if it occurs within the next 12 months, or a long-term liability if it occurs at a later date. When a long-term note payable has a short-term component, the amount due within the next 12 months is separately stated as a short-term liability.

Is the note a payment or a loan? Are the notes a payment or a credit? Notes payable is recorded as a debit entry. The cash account is calculated, and the balance sheet records it as a liability. This means that your balance sheet is recorded as a debit instead of a credit.

Is notes payable a current liability?

Examples of current liabilities include accounts payable, short-term debt, dividends, and notes payable as well as income tax owed.

What type of account is notes payable?

Notes payable is a liability account in the general ledger. Businesses use this account on their books to record written promises to repay creditors. Also, the lenders have recorded the written promise of the business to return the funds on their notes receivable.

Is note payable a liability or asset?

Notes payable are long-term debts that refer to the money a company owes to its investors—banks and other financial institutions—as well as other financial sources such as friends and family. It is long term because it is paid over 12 months, although usually within five years.

Is notes payable an asset or liability?

Notes payable are long-term debts that refer to the money a company owes to its investors—banks and other financial institutions—as well as other financial sources such as friends and family.

Is note payable a credit or debit?

Notes payable are appropriate for liability accounts because they are money owed to the company, or in other words, they are a credit to the business, not a debit.

What account type is notes payable?

Notes payable is a liability account in the general ledger. Businesses use this account on their books to record written promises to repay creditors. Also, the lenders have recorded the written promise of the business to return the funds on their notes receivable.

Is notes payable part of total debt?

Notes payable constitute a general component of current liabilities as shown on the balance sheet. These include the obligation to repay the loan within 12 months. A promissory note is a formal written promise to repay a loan at a stated rate of interest for a specified period of time.

What kind of debt can the notes pay for? Notes payable are long-term debts that refer to the money a company owes to its investors—banks and other financial institutions—as well as other financial sources such as friends and family. It is long term because it is paid over 12 months, although usually within five years.

Is notes payable included in accounts payable?

Many people use the terms AP and NP interchangeably, but there is a huge difference between the two. Accounts payable refers only to short-term debts, but notes payable can represent short-term or long-term debts and depends on the due date and terms outlined in the note.

What all is included in accounts payable?

Accounts Payable (AP) refers to obligations incurred by a company during its operations that are not yet due and must be paid in the short term. As such, AP is listed on the balance sheet as a current liability. Common payables include supplier invoices, legal fees, contractor payments, and so on.

What is the different between note payable and account payable?

The main difference between the two terms is that accounts payable are informal and short, without many specific obligations defined for the chosen supplier. Affidavits can be short or long, contain many terms, and are always formal written contracts.

Is notes payable the same as debt?

The main difference between notes payable and long-term debt is that they are essentially two different types of financing. A note payable is usually a short-term debt instrument. Conversely, long-term debt consists of obligations that are due for more than 12 months.

Is notes payable credit or debit?

When the debt is paid, the company records the notes payable as a debit, and credits the cash account, which is recorded as a liability on the balance sheet.

What is notes payable also called?

A promissory note is also called a promissory note or promissory note.

Are notes payable included in total debt?

A “note payable” is an evidence of debt. Notes payable can provide needed capital to the business, but, like other debts and obligations, the liability reduces the total equity of the business. Businesses report on their balance sheet notes payable on current or long-term debt.

Is notes payable included in total liabilities?

Key Takeaways Examples of current liabilities include accounts payable, short-term debt, dividends, and notes payable as well as income taxes owed.

What is included in total debt?

Total debt includes long-term liabilities, such as mortgages and other debts that do not mature for several years, as well as short-term obligations, including loan payments, credit cards, and account balances. can pay.

Are notes payable a current liability?

Examples of current liabilities include accounts payable, short-term debt, dividends, and notes payable as well as income tax owed.

Sources :

Comments are closed.