Contents

What are mortgage papers called?

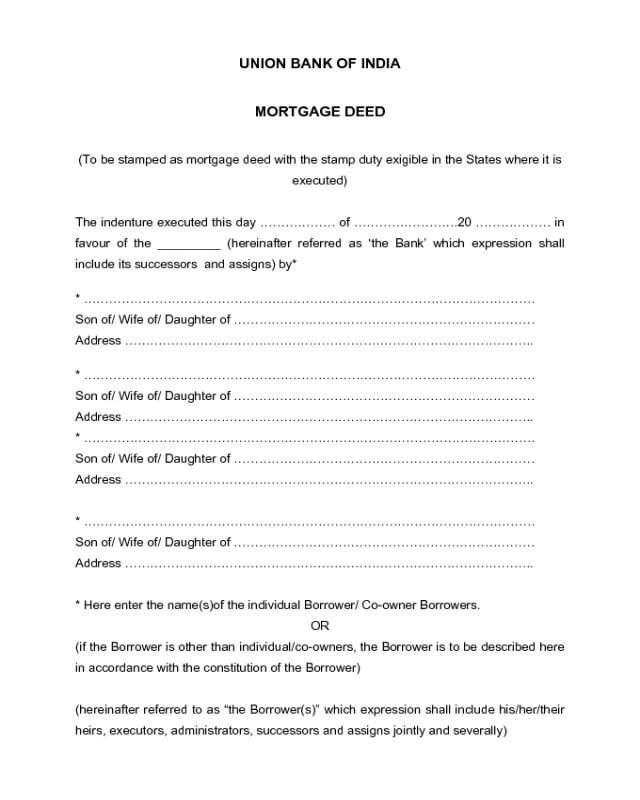

This document may be called a Mortgage, Security Tool, or Trust Deed. When you sign this document, you give the lender the right to seize your property by foreclosure if you fail to pay the mortgage under the terms you have agreed.

What is a copy of the mortgage note? This note includes the secured loan amount, loan repayment terms and payment method. The mortgage note is signed during the house closing and you can obtain a copy from the lender, your broker, and even the county registry.

What are the two main documents in a mortgage?

Again, the loan transaction consists of two main documents: the mortgage (or fiduciary deed) and a bill of exchange. The mortgage or deed of trust is the document that pledges the property to guarantee the debt and allows a lender to foreclose if you do not make the monthly payments.

Is a promissory note the same as a mortgage?

The bill of exchange, a contract separate from the mortgage, is the document that creates the loan obligation. This document contains the borrower’s promise to repay the borrowed amount. If you sign a promissory note, you are personally responsible for repaying the loan.

What else is a promissory note called?

Bills of exchange can also be referred to as bills of exchange, loan agreements or simply bills of exchange. It is a legal loan document which says that the borrower promises to repay the lender a certain amount of money in a certain amount of time.

Do you need a promissory note and a mortgage?

Yes, it is possible to have a bill of exchange without a mortgage if you are considering alternative forms of debt to finance the purchase of your home. In fact, a promissory note can be a way for those who are unable to obtain traditional financing to purchase a home again through what is called a take-back mortgage.

What is a Short Form deed of trust?

A & quot; short-form deed of trust & quot; is a document that is used to secure a bill using real estate as collateral. When a deed of trust is filed, it places a lien against the property.

What is the purpose of the trust deed? A trust deed is an agreement between a home buyer and a lender upon closing a property. It states that the home buyer will repay the loan and that the mortgage lender will retain legal title to the property until the loan is fully paid off.

What is a long form deed of trust?

California Long Form Deed of Trust Information A trust deed (DOT), also known as a trust deed, is a document that transmits the title of a real estate property to a trustee as collateral for a loan until the grantor (borrower) pays the lender according to terms defined in the bill.

How much is inheritance tax on property in France?

The French inheritance tax ranges from 0% to 60%. The different rates depend on the closeness between the deceased and the beneficiary. The tax is personal to each beneficiary and is not paid from the estate before any distribution of funds is made.

What is a trust called in France?

The new article 2011 of the French Civil Code defines a fiducie as a contract by which a company (the settlor) transfers assets or rights to another person (the trustee) who keeps them separate from its own property with a mandate to manage the property for for the benefit of one or more Beneficiaries.

What is a Short Form deed of trust and Assignment of Rents?

A trust deed with the assignment of fees acts as an additional guarantee for the lender. It gives the lender the right to collect the rents generated by the property if the loan payments are not made.

What is the purpose of an assignment of rents?

A “rent assignment” allows the lender to collect rent payments if the borrower defaults on loan payments.

What is Short form deed of trust?

A “short form deed of trust” is a document used to secure a promissory note using real estate as collateral. When a deed of trust is filed, it places a lien against the property.

What is a Short Form deed of trust California?

It is the deed that shows that the lender has an interest in the property while the landowner is paying the mortgage. An abbreviated trust deed to be used in typically smaller, non-institutional loans secured by any type of real estate (commercial and residential) located in California.

What is a short form of a trust?

TR. Confidence. Governmental »Law and law. Rate it: Tr.

What makes a deed of trust invalid in California?

Devils in the Details Courts wiped out fiduciary deed privileges due to simple mistakes. Giving the wrong legal address for the property or the wrong amount of debt can render the deed inapplicable. In some cases, the error is easy to correct and the court will determine that the act is enforceable.

What is an example of a deed?

The deed is defined as a title deed. An example of an act is a state ownership contract for land. noun. An instrument signed, sealed and delivered. noun.

What is the purpose of an act? A deed is the actual legal document that would transfer ownership (title) of a property from one person to another. The deed is signed by the person who sells or assigns the property rights, called the grantor. The person who buys or takes possession of the property rights is called the transferee.

What are a person’s deeds?

An act is an action you perform with intent, such as delivering a lost wallet you find in a store. Definitely a good deed. The word act is often used to describe acts of charity, but an action doesn’t have to be good to be called an act – people go to jail for their criminal acts.

What are good deeds meaning?

1: a thing that was done evil works did my good deed for the day. 2: a usually illustrious act or action: undertaking, exploiting the daring actions of a hero.

What are the most common deeds?

What are the three most common types of acts?

- General guarantee deed. …

- Special guarantee deed. …

- Withdrawal deed.

What are the most common deeds?

What are the three most common types of acts?

- General guarantee deed. …

- Special guarantee deed. …

- Withdrawal deed.

What deed is the best?

A guarantee deed is the best of the best. It protects you from all future and past problems with your title and any outstanding debt or lien.

What is the most common type of deed?

General deed of guarantee: A general guarantee deed is the most common type of deed used to transfer simple ownership of a paid property. Unlike a waiver, a general guarantee deed confirms a grantor’s ownership and a legal right to sell.

What is a deed in simple terms?

A deed is a signed legal document that transfers ownership of an asset to a new owner. Deeds are most commonly used to transfer ownership of property or vehicles between two parties. The purpose of an act is to transfer a title, the legal ownership of an asset or asset, from one person or company to another.

Are deed and title the same thing?

A deed is an official written document declaring the legal ownership of a person’s property, while a title refers to the concept of property rights. Here’s one way to remember the difference: Although you may own a physical copy of a book, you can’t hold a book title in your hand.

What does it mean to be in deed?

indeed; in truth; in truth. See Indeed.

Which of the following would not be on a deed of trust?

Which of the following wouldn’t be on a trust deed? The answer is interest rate. In the typical real estate sale transaction, the seller gives the buyer a closing deed and the buyer gives the lender a bill of exchange and a security instrument (i.e. a mortgage or trust deed) that creates a lien on the property.

Who are the parties in a trust deed quizlet? Does Deed of Trust have how many parties and who are they? 3 Parties – Lender (beneficiary), Borrower (Trustee), Trustee (appointed bank officer.

What is a deed of trust in NC?

A trust deed is a legal document that guarantees a real estate transaction. It works similar to a mortgage, although it’s not quite the same. Essentially, it states that a designated third party holds legal title to your property until you have repaid it under the terms of your loan.

What’s the difference between a deed and deed of trust?

A deed is a legal act that transfers ownership of a property from a seller to a buyer; whereas a trust deed is a document or mortgage alternative in many states that does not transfer ownership directly to the buyer but transfers it to a trustee or company that holds the title as collateral until …

Do I need a deed of trust?

No â a trust deed is not something you have to buy a house with another person. But with that said, you might want to consider it. Buying a new home with your partner, if you are not married, can be an exciting but stressful time.

When using a deed of trust the borrower conveys title to the?

Conversely, a trust deed involves three parties: a borrower (or trustee), a lender (or beneficiary) and the trustee. The trustee holds the title of pledge for the benefit of the lender; if the borrower defaults, the trustee will initiate and complete the foreclosure process at the request of the lender.

What kind of deed will the trustee use to convey the title to the borrower when the loan terms are satisfied?

A deed of retrocession is an instrument that transmits title from a trustee to the debtor-trustee when the borrowed money has been repaid to the lender.

When title to land is conveyed from a trustee to a borrower after the borrower pays off the loan the instrument used is a an?

A trust deed, also known as a trust deed, is a document sometimes used in real estate transactions in the United States. It is a document that comes into play when one party has taken out a loan from another party to purchase a property.

Which of the following are parties to a deed of trust?

A trust deed involves three parties: a lender, a borrower, and a trustee. The lender gives money to the borrower. In return, the borrower gives the lender one or more bills. As collateral for the bills, the borrower transfers a real estate interest to a third party trustee.

Which of the following is a third party under a deed of trust?

There are three parties involved in a trust deed: Trustee: this is the borrower. Trustee: This is the third party that will have the legal title. Beneficiary: This is the lender.

Who is the trustor in a deed of trust?

A trust deed is a three-part document prepared, signed and registered to guarantee the repayment of a loan. The Borrower (owner of the property) is called the “Trustee”, the Lender is called the “Beneficiary” and a third party is called the “Trustee”.

Sources :

Comments are closed.