Remember that buyers can make money from buying loans because they will receive interest from these loans, and they can buy them at a discount from lenders. Remember that customers can work with lenders who service their loans for them and receive monthly checks without checking with the borrower.

Contents

What is the difference between a mortgage and a mortgage note?

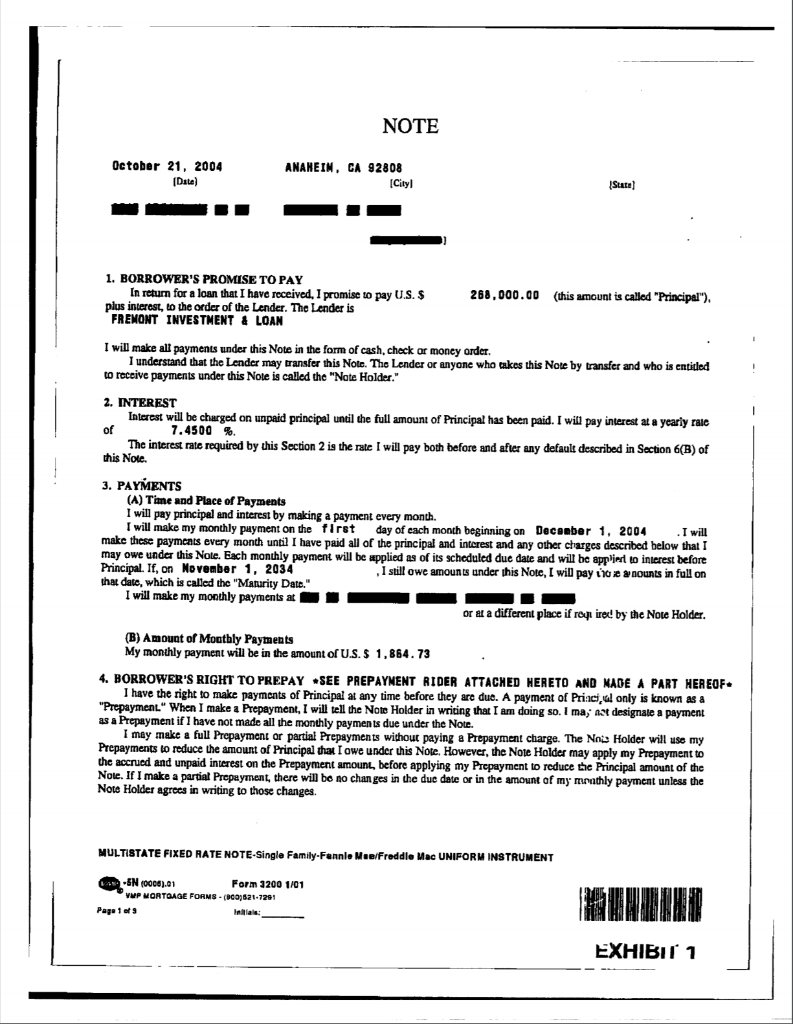

The difference between a Profile & a mortgage. The main difference between the promissory note and the mortgage, the promissory note is the written agreement that contains the details of the mortgage loan, but the mortgage is a loan secured by real property.

Is a mortgage the same as a mortgage letter? A mortgage deed is a legal document you sign when closing a mortgage. The mortgage note includes a promissory note, and a mortgage or deed of trust. The mortgage deed also secures your property as security for the loan.

What else is a mortgage note called?

In the United States, a mortgage deed (also known as a land deed, borrower’s deed) is a document that guarantees a mortgage loan.

Is a promissory note the same as a mortgage note?

Promissory Notes Vs. mortgage. A promissory note is a document between the borrower and the borrower in which the borrower promises to repay the borrower, a separate contract from a mortgage. A mortgage is a legal document that secures or “secures” a piece of real estate with an obligation to repay money.

Is a mortgage note the same as a deed?

Deed: A Deed is a document that commemorates the transfer of property from the Grantor to the Grantee. A Note is an unrecorded document that binds a debtor through a digital document-to-pay.

Can you be on the note but not the mortgage?

But just because they’re on the Mortgage, doesn’t mean they’re on the Note. For example, many times one spouse may have bad credit because they are not on the Note (lenders say “they are not on the loan”), but both spouses are on the Deed, so each spouse should be on it. the Mortgage.

Can my wife be on the title but not the mortgage?

Can I get my spouse on the title without them on the mortgage? Yes, you can put your spouse on the title without putting them on the mortgage. This means that the owner of the home is shared but not legally responsible for the mortgage payments.

What is the difference between signing the mortgage and the note?

So, by signing a promissory note, you promise to pay back the amount you borrowed, usually in monthly payments. Signing a mortgage gives the lender a way to get their money back if you don’t make the payments by foreclosing.

Can you buy mortgage notes?

Home mortgage loans can allow you to get regular income without the hassle of being a homeowner, or you can buy the mortgage. and sell it to another investor. Or a way to secure properties for less than their market value.

What happens when you buy a mortgage? However, unlike a real estate transaction, you do not own the property when you secure a mortgage. Instead, you become the new debtor of the borrower (homebuyer) by changing the bank in the transaction.

How much does a mortgage note cost?

Most mortgage investments range from $20,000 to $50,000 per note. The price will vary based on many factors, including the age of the book, payment history, loan-to-value ratio, and more.

Do you need a note with a mortgage?

If you take out a loan for the house and it is on the deed of the land, you may sign the mortgage. But even if the lender requires you to sign the mortgage, you may not need to sign the letter. For example, say you don’t qualify for a home loan at a good interest rate because you have bad credit.

How do you buy a home note?

Investors can buy mortgage information online, build a lender network, or get information from a number of sources, including:

- They are private equity holders, often financed by real estate or business investors.

- Hedge or private funds buy bulk from banks and service and then resell.

- Trade shows and markets.

Can I buy mortgage notes?

The process of buying a real estate mortgage loan Real estate loans are usually more expensive than non-real estate loans. They are usually not sold at a discount (at least compared to non-performing loans) and are generally not bought by banks. The purchase of performance information is usually done through private investors.

Is mortgage note investing profitable?

Investing in mortgage loans can be a great way to earn reliable monthly income. And there are some big financial benefits to be had too⦠if you know how!

Is buying notes a good idea?

Buy Performance This type of investment is probably best for you if you want fixed deposits that pay monthly income. Buying mortgage information is the easiest way to generate income, you can definitely find a source of good mortgage information for sale.

Is mortgage note investing profitable?

Investing in mortgage loans can be a great way to earn reliable monthly income. And there are some big financial benefits to be had too⦠if you know how!

What happens when you buy a note?

When you buy a note with a mortgage from the lender, you are buying the outstanding debt on the note, secured by the underlying asset. explained to the mortgagee. You are not buying the property. Sometimes, you may run into landlords who initially refuse to pay you because they don’t think they owe you anything.

How much does it cost to buy a mortgage note?

Most mortgage investments range from $20,000 to $50,000 per note. The price will vary based on many factors, including the age of the book, payment history, loan-to-value ratio, and more.

Is it a good idea to buy data? Buy Performance This type of investment is probably best for you if you want fixed deposits that pay monthly income. Buying mortgage information is the easiest way to generate income, you can definitely find a source of good mortgage information for sale.

How do you buy a home note?

Investors can buy mortgage information online, build a lender network, or get information from a number of sources, including:

- They are private equity holders, often financed by real estate or business investors.

- Hedge or private funds buy bulk from banks and service and then resell.

- Trade shows and markets.

How do I get a mortgage note?

To get a mortgage letter, you must apply for a loan on your loan. Once approved, they will send you a document that explains all the terms and conditions associated with your mortgage loan.

What is a note when buying a house?

A mortgage deed is a legal document that sets out all the terms of the mortgage between the borrower and their lending institution. It includes conditions such as: The home loan amount. The amount paid. Either monthly or bi-monthly is required.

How much money do you need to buy a note?

Most mortgage investments range from $20,000 to $50,000 per note. The price will vary based on many factors, including the age of the book, payment history, loan-to-value ratio, and more. When we buy a book, we first complete a background check to evaluate a book’s performance and assess its current market value.

How do you buy data? Investors can shop for mortgage information online, build a lender network, or get information from a number of sources, e.g. including: Buyers of books, often financing to buy real estate or business. Hedge or private funds buy bulk from banks and service and then resell. Trade shows and markets.

How much money do you need to invest in notes?

And because mortgage notes are backed by real property, the notes offer an additional degree of protection than stocks, bonds, and other paper securities. How much money do people usually save in mortgages? Most mortgage investments range from $20,000 to $50,000 per note.

How much do I need to invest in mortgage notes?

Generally, you should pay 20% as a down payment. So, the loan amount is $120,000. In exchange for $120,000, the lender will get you to sign a promissory note and mortgage.

What is note fund investing?

Note Fund investing technically means investing in the shares of a private company like PPR that manages a group of mortgages (aka notes), but participating in a note fund means investing in the company that manages the fund.

How much do I need to invest in mortgage notes?

Generally, you should pay 20% as a down payment. So, the loan amount is $120,000. In exchange for $120,000, the lender will get you to sign a promissory note and mortgage.

Is mortgage note investing profitable?

Investing in mortgage loans can be a great way to earn reliable monthly income. And there are some big financial benefits to be had too⦠if you know how!

Sources :

Comments are closed.