A promissory note is different from an I.O.U. because a promissory note says that a person will return the money and states how and when it will be paid and other details. An I.O.U. it just says that a person owes a debt to another person.

Contents

What is promissory note in simple words?

Definition of promissory note: A written promise to pay at a specified or determinable future time a sum of money to a specified person or bearer.

What is a promissory note for? A promissory note is a key piece of a home loan application and mortgage contract, which guarantees that the borrower agrees to become indebted to a lender for the repayment of the loan. Ultimately, it serves as a necessary piece of the legal puzzle that helps ensure sums are repaid in full and in a timely manner.

What is the meaning of promissory note in business?

An unconditional promise to pay a specified amount of money to a designated person or noteholder, or to deposit such money as directed by such persons. A promissory note must be in writing and signed by the promisor. business law

What is promissory note example?

A simple promissory note could be for a lump sum payment on a certain date. For example, you lend $1,000 to your friend and he promises to pay you back by December 1st. The full amount is due on this date and there is no payment schedule.

What are three types of promissory notes?

Promissory note type

- I will pay simple.

- demand promissory note

- I will pay insured.

- I will pay without collateral.

What is a promissory note also called?

Promissory notes, also known as mortgage promissory notes, are written agreements in which one party agrees to pay another party a certain amount of money at a later date. Banks and borrowers usually accept these notes during the mortgage process.

Is a promissory note the same as a loan?

A promissory note is essentially an unconditional written promise to pay a loan or other debt, at a fixed or determinable future date. Although legally enforceable, a promissory note is less formal than a loan agreement and is appropriate where smaller sums of money are involved.

What else is a promissory note called?

Promissory notes may also be called a credit agreement, a loan agreement, or just a note. It is a legal loan document that says the borrower agrees to repay the lender a certain amount of money within a certain period of time.

What is promissory note answer?

A promissory note is a legal and financial instrument declared by one party promising another party to pay the debt on a certain date. It is a written agreement signed by the drawee with a promise to pay the money on a certain date or whenever asked.

What are three types of promissory notes?

Promissory note type

- I will pay simple.

- demand promissory note

- I will pay insured.

- I will pay without collateral.

WHO issues promissory note?

Promissory notes are debt instruments. They can be issued by financial institutions. However, they can also be issued by small businesses or individuals. They allow a person or a company to obtain financing without going through a bank.

What is needed to make a promissory note legal?

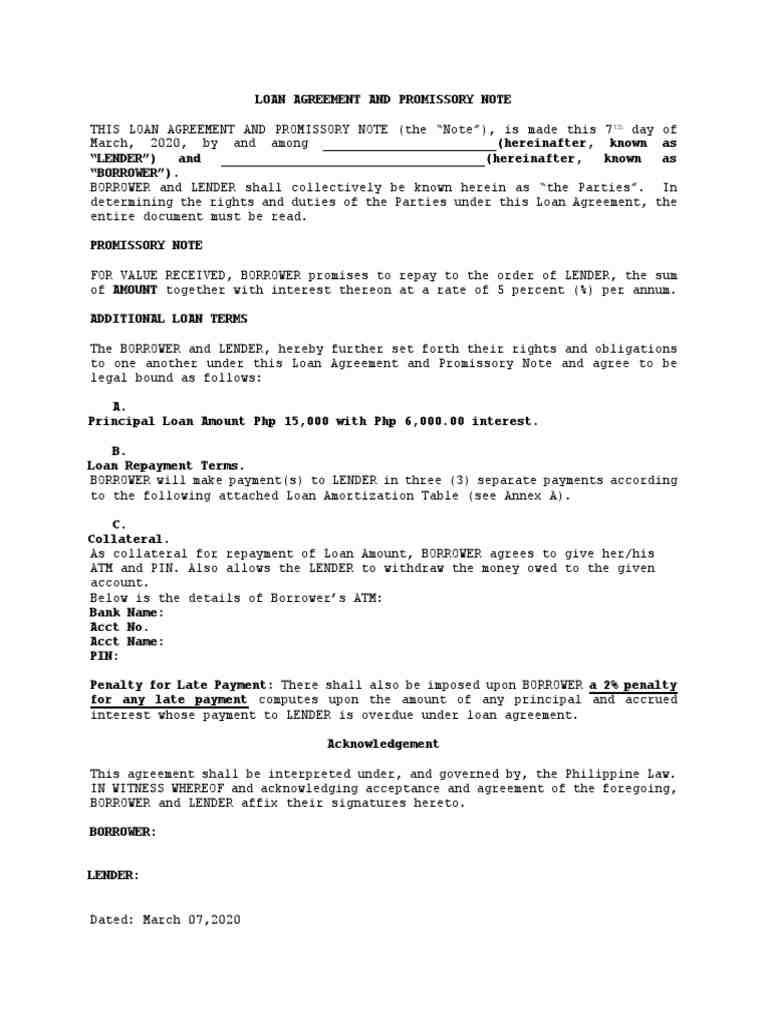

For a promissory note to be valid and legally binding, it must include specific information. "A promissory note must include details such as the amount borrowed, the repayment schedule and whether it is secured or unsecured" says Wheeler.

Is a promissory note valid if it is not legalized? In general, promissory notes do not need to be notarized. Normally, legally enforceable promissory notes must be signed by individuals and contain unconditional promises to pay specific amounts of money. They usually also state payment due dates and an agreed interest rate.

Can promissory notes be legally accepted?

Promissory notes are legally binding whether the promissory note is secured by collateral or based solely on the promise of repayment. If you lend money to someone who defaults on a promissory note and defaults, you can legally own any property that person has pledged as collateral.

Does a promissory note hold up in court?

In general, as long as the promissory note contains legally acceptable interest rates, the signatures of both contracting parties, and are within the applicable prescription, can be confirmed in court.

How do you legally enforce a promissory note?

To enforce a promissory note, the holder must give notice as required on the promissory note. If the borrower fails to make the payment on time, the noteholder may file an action to recover the payment.

What are the legal requirements for a promissory note?

An unconditional promise to pay a specified amount of money to a designated person or noteholder, or to deposit such money as directed by such persons. A promissory note must be in writing and signed by the promisor.

What items must be included in a promissory note?

While each state has its own individual rules governing what must be included in the document, the standard items you might expect to see contained in a promissory note include: Borrower’s name and contact information. Lender details and contact information. Principal loan amount.

Does a promissory note hold up in court?

In general, as long as the promissory note contains legally acceptable interest rates, the signatures of both contracting parties, and are within the applicable prescription, can be confirmed in court.

Does a promissory note hold up in court?

In general, as long as the promissory note contains legally acceptable interest rates, the signatures of both contracting parties, and are within the applicable prescription, can be confirmed in court.

What makes a promissory note legally binding?

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the interest rate, any collateral involved, and the repayment term. When this document is signed by the borrower, it becomes a legally binding contract.

What voids a promissory note?

Even if you have the original note, it may be invalid if it was not written correctly. If the person you’re trying to pick up didn’t sign it… and yes, it happens… the note is void. It can also be void if you broke some other law, for example, if you were charging an illegally high interest rate.

What is the difference between a note and a loan?

The difference between a promissory note and a mortgage. The main difference between a promissory note and a mortgage is that a promissory note is the written agreement that contains the details of the mortgage loan, while a mortgage is a loan secured by real estate.

Do you need both a promissory note and a loan agreement? There is often no legal requirement that a promise to pay be evidenced in a promissory note, nor any prohibition against including it in a loan or credit agreement. Although promissory notes are sometimes thought to be negotiable instruments, this is usually not the case.

Is a note and a loan the same thing?

In general, promissory notes are used for more informal relationships than loan agreements. A promissory note can be used for loans from friends and family, or small short-term loans. Loan agreements, on the other hand, are used for everything from vehicles to mortgages to new businesses.

Is loan and note the same?

A promissory note can be used for loans from friends and family, or small short-term loans. Loan agreements, on the other hand, are used for everything from vehicles to mortgages to new businesses. Most banks and other large financial institutions have specific loan documents that they use for specific situations.

Is a loan called a note?

A loan note is a type of payment contract that describes the legal obligations of the lender and the borrower. A loan note is a legally binding agreement that includes all the terms of the loan, such as the payment schedule, due date, principal amount, interest rate, and any prepayment penalties.

Which is better promissory note or loan agreement?

If the sum is not large and the relationship is one of trust, it is preferable to go with a promissory note to avoid possible legal problems. However, if the sum of money is huge and the relationship is not entirely reliable, be sure to use a secured loan agreement to ensure that your money is safe with the borrower.

Why do you need a promissory note and a loan agreement?

A loan and promissory note is a formal document that describes the terms of a contract between two parties. It includes things like interest rates, repayment schedules, and other aspects of the debt. A promissory note is a way to legally enforce a loan agreement with another party.

What is the difference between a business loan agreement and promissory note?

In other words, a promissory note is a document that details your promise to repay a loan, but doesn’t give much more information. A business loan agreement, on the other hand, includes all the details that are involved in the loan agreement between you and the lender.

Is a bank note a loan?

Short-term bank notes are loans from a bank that mature in one year or less.

Do you have to pay back Master promissory note?

A master promissory note (MPN) is an agreement between you and the government to repay your debt. You agree to use loan funds only for authorized academic expenses when you sign an MPN. If you don’t meet the terms of your MPN, you could end up defaulting on your loan.

Do you have to fill out a master slip every year? All borrowers must complete an MPN before they can receive a federal student loan. Certain circumstances may require you to sign an MPN more than once: If you receive a type of loan for which you have not previously signed an MPN. If your school requires you to sign a new MPN each academic year.

What is the purpose of a master promissory note?

ââââââA MPN is a legal document that contains the rights and responsibilities of the borrower and the terms and conditions for repayment. Direct PLUS and Direct Subsidized/Unsubsidized loans have different MPNs.

What does the Master Promissory Note explain?

A master promissory note (MPN) is a contract between you and your federal student loan lender where you agree to the terms and conditions of the loan. It’s a legally binding agreement, so if you break it, like if you don’t pay back your student loans, your lender can sue you.

Why do I need a master promissory note?

ââââââA MPN is a legal document that contains the rights and responsibilities of the borrower and the terms and conditions for repayment. Direct PLUS and Direct Subsidized/Unsubsidized loans have different MPNs. An MPN can also be good for up to 10 years if certain enrollment requirements are met.

How long is the master promissory note?

In most situations, you will only sign one master promissory note for multiple subsidized and unsubsidized loans, and it will last up to 10 years of continuing education.

Do you have to do a MPN every year?

Question: Will I need to complete a Master Promissory Note (MPN) each year? Answer: In most cases, for both subsidized and unsubsidized loans, once you submit your MPN and get it accepted, you will not need to fill out a new MPN for future loans you receive.

How often do you have to complete a MPN?

The school requires you to sign a new MPN each academic year. (Most schools do not require a new MPN every academic year.) You signed an MPN more than a year ago, but no loans were disbursed.

Comments are closed.