Contents

How much do mortgage notes sell for?

The value of a mortgage note depends on various factors. Respective customers can pay up to $0.70 per dollar of residual income, depending on the amount of risk they have to take when buying the article.

Why do banks sell mortgage notes? Banks often sell mortgage notes to increase their income, especially when they are close to the limit they are required to carry. Since banks often sell mortgage notes in bulk, you would need millions of dollars to invest in them. Instead, knowing where to buy mortgage documents online will help you invest in a home loan.

How do you sell a house note?

How Can You Sell Your Mortgage Note?

- Gather all the information you have.

- Give this information to a mortgage loan company for a free estimate.

- Review the quote before submitting the contract.

- The purchasing company goes through a due diligence phase to acquire the purchasing information systematically.

How do you sell a mortgage note?

Selling a Mortgage Note A mortgage note is usually sold to a buyer when the seller no longer wants to wait for payment and needs a sum of money immediately. In this case, the current owner of the mortgage note would sell the note, relinquishing his claim to the borrower’s obligations.

How does a house note work?

A promissory note, also known as a promissory note or mortgage promissory note, is a legal document that binds you to repay your loan within an agreed time period. The letter also outlines the terms of your loan agreement with your mortgage lender.

Is mortgage note investing profitable?

Investing in mortgage notes can be a great way to generate reliable monthly income. And there are also some potentially very large financial resources to be had⦠if you know how to go about it!

What does it mean to invest in mortgage notes?

Mortgage note investing is a way of owning real estate without managing it or being a mortgage, where the homeowner pays an investor rather than a bank. It is a low-cost way to invest in real estate.

Are mortgage notes profitable?

Investing in mortgage notes is a great way to build capital that often requires minimal management. From finding the right company, buying the note, or buying and servicing the note, it’s an easy way to make money on a monthly basis without going to properties or tenants.

Can you sell a mortgage note?

Selling a Mortgage Note A mortgage note is usually sold to a buyer when the seller no longer wants to wait for payment and needs a sum of money immediately. In this case, the current owner of the mortgage note would sell the note, relinquishing his claim to the borrower’s obligations.

How do you value a mortgage note?

The role of a business analyst when valuing a confidential article is twofold. First, they must determine the market rate of interest based on the risk of the note and, second, they must calculate the present value of the future principal and interest payments of the note using the expected amortization.

Can you sell a mortgage loan?

If a mortgage lender has their money in that transaction for a full 30 years, they will have less money to provide for future loans. By allowing the mortgage to be sold to an investor, the lender now has the capital and cash flow to continue lending to other borrowers.

Will a promissory note hold up in court?

Generally, as long as the promissory note contains legally acceptable terms, signatures of both contracting parties, and is within the applicable Statute of Limitations, it can be upheld in a court of law.

What happens if I don’t pay my promissory note? What Happens If the Guarantee Is Not Paid? Promissory notes are legally binding documents. A person who defaults on a loan specified in a promissory note may lose the property that secures the loan, such as a home, or face other actions.

Is a promissory note enforceable in court?

Promissory Notes are legally binding if the note is secured by collateral or based solely on a promise to pay. If you lend money to someone who defaults and they don’t pay, you can legally take any property pledged by the person as collateral.

What makes a promissory note unenforceable?

A promissory note may be invalid if it does not include A) the total amount the borrower owes the lender (aka the amount of the note) or B) the number of due payments and each additional due date.

What voids a promissory note?

Even if you have an original article, it may be incomplete or not written properly. If the person you are trying to take from does not sign â and yes, this happens â the document is useless. It can also be void if it violates another law, for example, if it charges an unlawfully high rate of interest.

What makes a promissory note invalid?

A promissory note may be invalid if it does not include A) the total amount the borrower owes the lender (aka the amount of the note) or B) the number of due payments and each additional due date.

What is required for a promissory note to be valid?

The promissory note should include the date of the loan, the dollar amount, the names of both parties, the interest rate, any contractual obligations, and the payment period. If this document is signed by the borrower, it becomes a legal agreement.

How long is a promissory note valid?

Depending on where you live, the statute of limitations regarding promissory notes can vary from three to fifteen years. Once the statute of limitations expires, the creditor can no longer file a lawsuit related to the unpaid promissory note.

What makes a promissory note legally binding?

The promissory note should include the date of the loan, the dollar amount, the names of both parties, the interest rate, any contractual obligations, and the payment period. If this document is signed by the borrower, it becomes a legal agreement.

What are the conditions of a promissory note?

Important elements of any written guarantee should include the following: Payor or borrower : Include the name of the party who has promised to pay the said loan. Payee or lender: Include the name of the lender, person or organization, that lends the money. Date : Enter the exact date the refund guarantee will be effective.

Does a promissory note mean you got the loan?

A promissory note is a written agreement between one party (you, the borrower) to repay a loan issued by another party (usually a bank or other financial institution).

Is a promissory note the same as a loan? A promissory note is an unconditional written promise to pay a loan or other debt, at a specified or foreseeable future date. Although legally acceptable, a promissory note is less effective than a loan agreement and is appropriate where a small amount of money is involved.

Does promissory note mean approved?

The promissory note will include the terms agreed upon between the two parties, such as the maturity date, principal, interest, and signature of the issuer. Essentially, a guarantee document allows organizations other than financial institutions to be able to offer ways to lend to other organizations.

What happens when you issue a promissory note?

Promissory notes legally bind the borrower and lender in an agreement where the borrower is obligated to repay the loan or debt. They determine the terms of the loan and outline the loan repayment period as well as any interest that may accrue over the life of the loan.

Does a promissory note need to be accepted?

A promissory note requires acceptance.

What does signing a promissory note mean?

Promissory notes legally bind the borrower and lender in an agreement where the borrower is obligated to repay the loan or debt. They determine the terms of the loan and outline the loan repayment period as well as any interest that may accrue over the life of the loan.

Is a signed promissory note legally binding?

Promissory Notes are legally binding if the note is secured by collateral or based solely on a promise to pay. If you lend money to someone who defaults and they don’t pay, you can legally take any property pledged by the person as collateral.

What happens after signing promissory note?

After you sign your MPN, it becomes a legally binding agreement that will apply to student loans you take out over a 10-year period. You will be required to comply with the terms of the agreement and repay your loan even if you drop out of school or are unhappy with your educational experience.

What does a promissory note do?

The promissory agreement is an important part of applying for a home loan and mortgage agreement, to ensure that the borrower agrees to be indebted to the lender to repay the loan. Ultimately, it serves as a necessary piece of the legal puzzle that helps ensure that money is paid in full and on time.

What is a promissory note and how does it work?

What does a Promissory Note contain? A form of credit instrument, a promissory note represents a written promise on the part of the issuer to repay another party. The promissory note will include the terms agreed upon between the two parties, such as the maturity date, principal, interest, and signature of the issuer.

Is a promissory note worth anything?

A Promissory Note is an Important Instrument It provides a clear structure for the payment of the loan and protects the lender from default and the borrower from dishonest lending practices.

What is a mortgage document?

The Mortgage or Deed of Trust is a legal document in which the borrower transfers title to a third party (trustee) to act as collateral for the lender. When the loan is paid in full the trustee transfers the title to the borrower.

What is a credit card? The notice will give you information about your loan, including the amount you owe, the mortgage interest rate, the payment dates, the payment period, and the payment location. to be sent

What is the difference between a note and a mortgage document?

A promissory note is a document between a lender and a borrower in which the borrower promises to repay the lender, which is a separate contract from the loan. A mortgage is a legal document that binds or “secures” a piece of real estate to an obligation to repay the money.

Is a note a mortgage document?

The promissory note, a separate contract from the mortgage, is the document that creates the loan obligation. This document contains the borrower’s promise that he will repay the money he has borrowed. If you sign a promissory note, you are personally responsible for paying the loan.

Can you be on the mortgage but not the note?

But just because they’re on the Mortgage, doesn’t mean they’re on the List. For example, many times one spouse may have bad credit so they are not on the Deed (lenders sometimes say they are not on credit), but both spouses are on the Deed, so both spouses must be on the Deed. the Mortgage.

What is the meaning of mortgage documents?

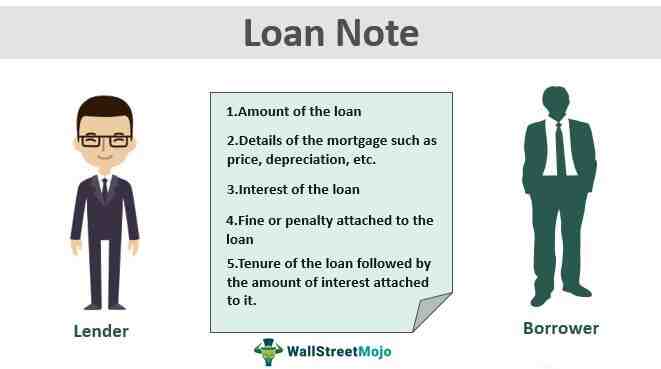

A mortgage note is a legal document that sets out all the terms of a mortgage between the borrower and their lending institution. It includes terms such as: The total amount of the home loan. Down payment. It may be necessary to pay monthly or bi-monthly.

What are the two main documents in a mortgage?

Again, the loan transaction has two main documents: the mortgage (or deed of trust) and the promissory note. The mortgage or deed of trust is a document that pledges the property as collateral for the loan and allows the lender to foreclose if you fail to make monthly payments.

How do you read mortgage documents?

What can I use as proof of mortgage?

Top 5 Articles to Give to Your Mortgage Lender

- W-2 Forms and Tax Returns. Part of your paycheck reports your income, so you’ll need to provide your most recent W-2 forms and tax returns to prove it. …

- Pay Stubs. …

- Bank Statements. …

- Identification. …

- Proof of Reserves.

What is a proof of mortgage?

A proof of deposit (POD) is either proof that the home borrower has the money to pay or the dollar amount of the deposit is correct. Mortgage lenders will require the POD to prove that the borrower has enough cash to pay for the property.

What are the two main documents in a mortgage?

Again, the loan transaction has two main documents: the mortgage (or deed of trust) and the promissory note. The mortgage or deed of trust is a document that pledges the property as collateral for the loan and allows the lender to foreclose if you fail to make monthly payments.

Sources :

Comments are closed.