Contents

Who signs the mortgage and the note?

Who Signs the Mortgage Note? Because the loan amount states the amount of the loan, the interest rate and binds the borrower himself to pay the amount, the borrower signs the loan document.

Does the mortgage need to be signed by the buyer? ATG has received questions from members, closings, and lenders about who should co-sign for a mortgage. All title holders of the real estate parcel must sign any mortgage. People without assets can also sign a mortgage without causing problems.

Who signs a promissory note at closing?

Only the borrower signs the promissory note, while the lender and borrower sign the loan agreement. A signed document means that the borrower agrees to pay the loan.

Does promissory note have to be signed by lender?

Incomplete signatures I BACK: Both parties must sign the promissory note! This means that both the lender and the borrower must sign the original document (as well as amended versions). Without signatures, the promissory note has no legal leg to stand on.

What signatures are needed on a promissory note?

These are the names and signatures of both parties (lender and borrower), the amount of the loan, and the due date of the loan payment (or each payment).

What is the person who signs a mortgage called?

Many people finance the purchase of real estate through mutual funds. The two main parties involved in this financial agreement are the borrower and the borrower. A mortgagor is a person who borrows money to pay for his house. The borrower is often referred to as the borrower or the customer.

What is a mortgage signatory?

A mortgage cosigner takes on the responsibility of ensuring that the mortgage loan is paid off. Some borrowers need help from a financially secure cosigner to qualify for a mortgage, and those who do need to understand exactly what they’re getting into.

Who is mortgagee vs mortgagor?

The borrower can be a single person or a group of people, depending on who is requesting the loan. While the mortgage holder is the institution that lends money to the householder to finance the purchase of a house or repay their mortgage.

What is the difference between signing the mortgage and the note?

So, by signing a promissory note, you promise to pay back the money you borrowed, usually in monthly installments. Cosigning a loan gives the lender a way to get their money back if you don’t pay it—through foreclosure.

Is the mortgage agreement Same as note?

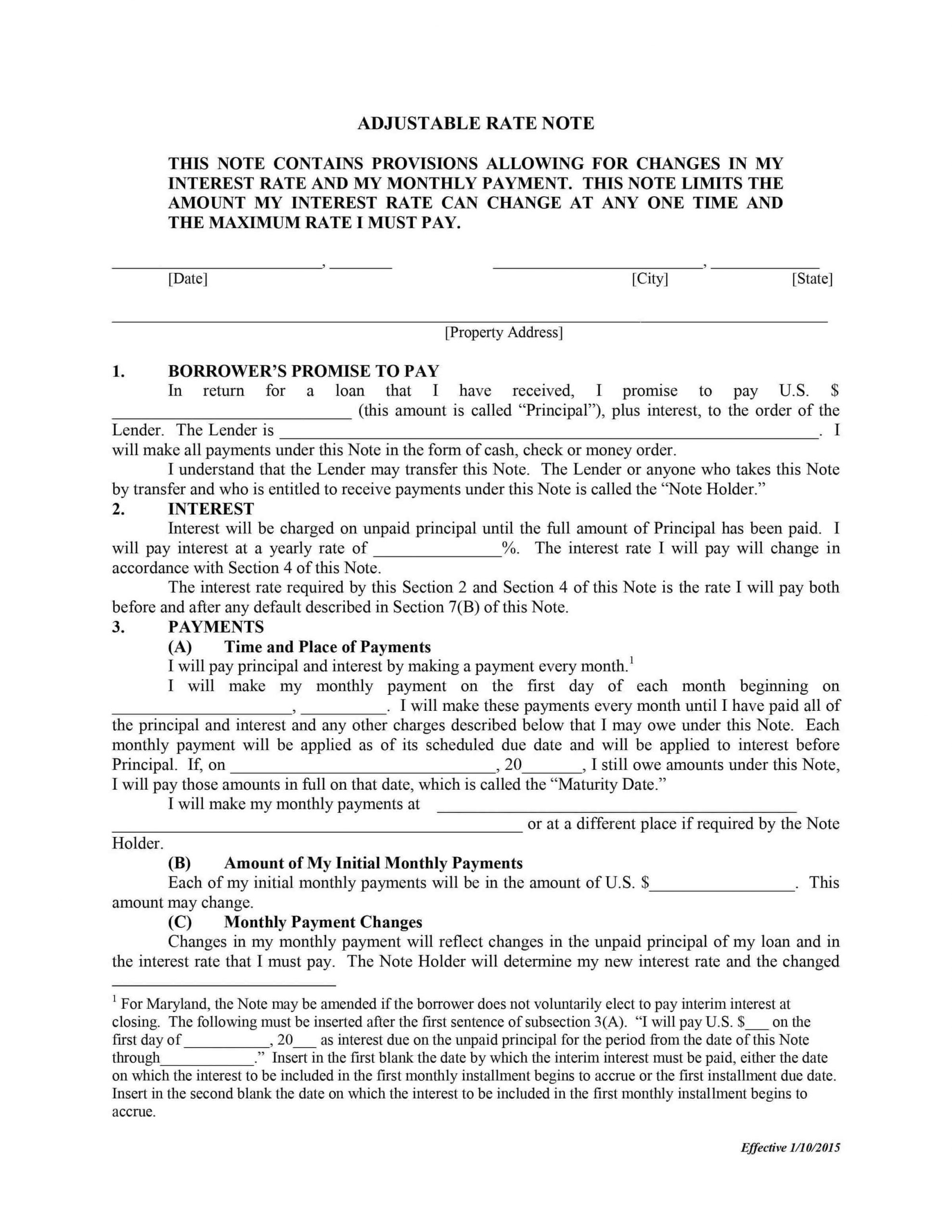

A promissory note is a document between a lender and a borrower in which the borrower promises to repay the lender, which is a separate contract from the loan. A mortgage is a legal document that binds or “secures” a piece of real estate to an obligation to repay the money.

What is a mortgage and mortgage note?

A mortgage is a type of contract. What makes it special is that the loan is secured by real estate. A mortgage note is a document you sign at the end of your mortgage. It must accurately reflect the details of the agreement between the borrower and the lender or be corrected immediately if it does not.

Does it matter who is the primary borrower?

The person with the most money is always considered the first borrower. Having two borrowers on a loan can help you qualify for a larger loan, as you can combine your incomes to determine your loan-to-income ratio. But if one of them has bad credit, that may not be good for you.

Does it matter who is the primary borrower on the loan? When evaluating federal loan borrowers, the lender does not care about who is listed first, and more about the amount of the applicant’s income and debts. Generally, the lender evaluates the application in the order in which applicants submit it, regardless of who is listed first.

Who should be the primary borrower on a loan?

The first debtor is the recipient of the bills in the case of signing, although the debtor can come after the signatory if the debtor defaults.

Can there be two primary borrowers?

A joint loan or shared loan is a loan made to two or more borrowers. All borrowers are equally responsible for repaying the loan, and each borrower usually has an ownership interest in the property to which the loan is directed.

Does it matter who the primary borrower is?

Co-Owners and Joint Mortgages Now the first borrower is the person with the best credit score, because a higher score equals a better interest rate. If all borrowers have the same amount, the lender will list the person with the highest amount as the first borrower.

Does it matter who is primary on a loan?

Lenders often rely on automated underwriting software to process applications — first. The loan will eventually go to an underwriter who will review the income, assets, employment and credit information. It is against the law for mortgage lenders to base their decision on the gender of the first applicant.

Does it matter who the primary borrower is?

Co-Owners and Joint Mortgages Now the first borrower is the person with the best credit score, because a higher score equals a better interest rate. If all borrowers have the same amount, the lender will list the person with the highest amount as the first borrower.

What does it mean to be primary on a loan?

Other Definitions of Primary Loan Primary Loan refers to the loan provided by the primary lender that is used by the applicant to buy a home. The first loan offers a fixed interest rate and equal monthly payments of principal and interest over the term of the loan.

Does it matter who is borrower and co-borrower?

Does it matter who is the borrower and who is the borrower? Since the borrower and the borrower are jointly responsible for the payment of the loan and both may have a claim on the property, the simple answer is that it probably doesn’t matter.

Who is borrower who is co-borrower?

A co-borrower is a person who applies for and shares a loan with another borrower. In this situation, all borrowers have a duty to pay. Often, they also share the title of the house or other property that the loan belongs to.

Are borrower and co-borrower the same?

The borrower is the person who is fully responsible for repaying the loan, while the borrower is someone who is added to the loan usually to help the borrower with approval. The borrower takes the risk that he may have to repay the loan if the borrower defaults.

Is there a difference between borrower and co borrower?

The borrower is the person who is fully responsible for repaying the loan, while the borrower is someone who is added to the loan usually to help the borrower with approval. The borrower takes the risk that he may have to repay the loan if the borrower defaults.

What does borrower and borrower mean? A co-borrower is a person who applies for and shares a loan with another borrower. In this situation, all borrowers have a duty to pay. Often, they also share the title of the house or other property that the loan belongs to.

Does it matter who is borrower and co-borrower on mortgage?

Does it matter who is the borrower and who is the borrower? Since the borrower and the borrower are jointly responsible for the payment of the loan and both may have a claim on the property, the simple answer is that it probably doesn’t matter.

Is it better to be borrower or co-borrower?

Co-borrowing is ideal for people, such as married couples, who want to share the responsibility of paying the debt and getting the assets tied to the debt. On the other hand, co-signing is ideal for a borrower who does not meet the lender’s requirements and needs help getting a loan or a low interest rate.

What is the difference between co-borrower and joint borrower?

Co-borrowers are equally liable for the rent and have an undivided ownership interest in the property. Joint Borrowers are equally liable for the mortgage note but may have different ownership interests in the property.

What does joint borrower mean?

Co-borrowing is a process of taking out a loan or other type of financing with another person, usually called a co-borrower. If your application is approved, your joint loan or credit card will be issued in both your names and you are both legally authorized to repay the loan.

Is a co-borrower a joint owner?

The co-borrower and cosigner are both responsible for paying the debt, but the co-borrower owns the joint money or asset, while the cosigner does not.

Is it better to be borrower or co-borrower?

Co-borrowing is ideal for people, such as married couples, who want to share the responsibility of paying the debt and getting the assets tied to the debt. On the other hand, co-signing is ideal for a borrower who does not meet the lender’s requirements and needs help getting a loan or a low interest rate.

Does being a co-borrower help your credit?

Yes, being a cosigner on a car loan will help you build your credit history. The cosigner and cosigner share equal responsibility for the loan, and the loan will appear on both your credit report and theirs.

Is it better to buy a house with a co-borrower?

Having a co-borrower means you can borrow more and can get a better mortgage rate. That’s because two salaries and two sets of minimum payments are involved. And combining that often means that buyer-buyers can become homeowners sooner than if they were to apply separately.

What happens if I’m not on the mortgage and my husband dies?

Federal law prohibits the enforcement of a portion of a commercial loan in certain cases, such as transfers to relatives when the borrower dies. Even if your name is not on the loan, once you receive title to the property and get the lender’s approval, you can take out the existing loan.

What happens if my wife is not at home? If your spouse is not on the mortgage, they are not responsible for paying it. However, the borrower’s lender can foreclose on the home if the loan is not paid.

Should deceased spouse be removed from mortgage?

When someone who owns real property dies, the property goes into probate or simply passes, by operation of law, to the existing co-owners. Usually, the remaining co-owners do nothing with the title as long as they own the property. However, good practice is to remove the deceased’s name from the name.

Do I have to tell mortgage company of death?

As an heir or executor, it may also be your responsibility to notify the mortgage company of your loved one’s death. You should notify them as soon as possible, but you usually have 30 days to do so.

Can a mortgage stay in a deceased person’s name?

If you inherit a mortgaged house from a relative, the beneficiary can keep the house in that relative’s name, or take it. However, relatives who inherit the mortgaged house must live in it if they want to keep the mortgage in the name of the deceased relative.

Do I have to tell my mortgage company my husband died?

As an heir or executor, it may also be your responsibility to notify the mortgage company of your loved one’s death. You should notify them as soon as possible, but you usually have 30 days to do so.

Is a surviving spouse responsible for a mortgage?

If your spouse cannot pay the entire mortgage, your spouse will be responsible for the remaining debt if they want to keep the property.

What happens to a mortgage when one spouse dies?

Since the surviving spouse inherited the home from your spouse, you may be eligible to take possession of the home under federal law. Alternatively, you may be able to refinance the mortgage. Another possible option is to take out a reverse mortgage to pay off the existing mortgage.

What happens to my mortgage when my husband dies?

If you inherit a home and have previously signed a promissory note and mortgage for that property, you also inherit the mortgage. However, if your spouse (or the other borrower dies) has home insurance, that policy will cover the loan.

How do I take my deceased husband off the mortgage?

Using a Surviving Affidavit to Remove a Deceased Owner from a Title. If you are already listed as a co-owner on the original deed—or have inherited an interest through a life estate deed, transfer-on-deed, or lady bird deed—you can use a survivorship affidavit to remove the decedent’s ownership.

Will my mortgage be paid off if my spouse dies?

If you and your spouse have a mortgage on the home at the time of your spouse’s death, you will be fully responsible for paying it each month. In many countries, the mortgage lender has a lien on your home until you pay the loan company in full.

Sources :

Comments are closed.