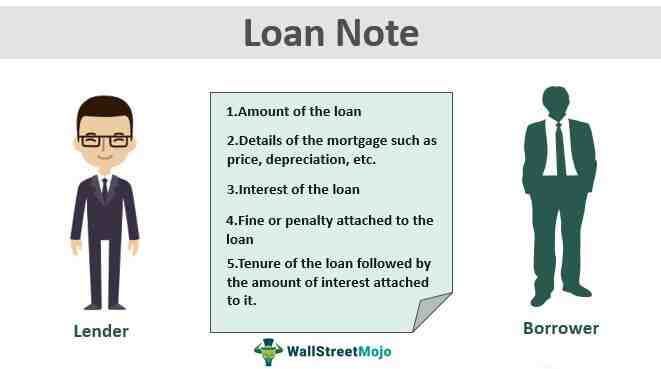

The notice will give you details about your loan, including the amount you owe, the mortgage loan interest rate, the dates when payments are due, the length of time for repayment, and the location where the ‘Payments are. be sent

Contents

What is another name for a promissory note?

| cosigned debt | IOU |

|---|---|

| noted | Note by hand |

| Notice to pay | P/N |

What is a debt in real estate? The debt. The promissory note, a contract separate from the mortgage, is the document that creates the loan obligation. This document contains the borrower’s promise to repay the borrowed amount. When you sign a promissory note, you are personally liable to repay the loan.

Is a promissory note a debenture?

[Latin, Are due.] A debt or obligation offered by a corporation to a creditor in exchange for a loan, the repayment of which is supported only by the general creditworthiness of the corporation and not by a mortgage or lien on any particular property.

What are the kinds of debentures?

Secured and Unsecured, Registered and Bearer, Convertible and Non-Convertible, First and Second are four types of bonds.

What type of debt is a promissory note?

A form of debt instrument, a promissory note represents a written promise by the issuer to repay another party. A promissory note contains the agreed terms between the two parties, such as the maturity date, principal, interest and the signature of the issuer.

What is promissory note in simple words?

Definition of promissory note: a written promise to pay a sum of money to a specified individual or bearer at a fixed or specified future time.

What is the meaning of promissory note in business?

An unconditional promise to pay a certain sum of money to a named party or the holder of the note, or to deposit that money directly with such persons. A writing must be in writing and signed by the maker of the pledge. business law.

What is promissory note answer?

A promissory note is a legal, financial instrument that is declared by one party, promising another party to pay the debt on a certain day. It is a written agreement signed by the drawer with a promise to pay the money on a specific date or whenever requested.

Is a promissory note a contract?

As long as it meets these requirements, a promissory note is a legitimate, legally binding contract. A debt can be a simple agreement about the terms of the loan from one person to another. In addition to loans, individuals can use promissory notes during a private vehicle transaction.

What makes a promissory note legal?

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the interest rate, any collateral involved and the timeline for payment. When this document is signed by the borrower, it becomes a legally binding contract.

What happens if a promissory note is not paid?

Default on Secured Debt If you have not paid under the terms of the debt, the dealer has the right to send someone to repossess the car.

What is the difference between a note and loan?

A promissory note is essentially an unconditional written promise to repay a loan or other debt at a fixed or specified future date. Although legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved.

Is a note a loan? A note is a legal document representing a loan made by an issuer to a creditor or an investor. Notes include payment of the principal amount borrowed, as well as any predetermined interest payments. The US government issues Treasury Notes (T-Notes) to raise money to pay for infrastructure.

Do you need both a promissory note and a loan agreement?

Often there is no legal requirement that a promise to pay be evidenced in a promissory note, nor is there a prohibition on including it in a loan or credit agreement. Although promissory notes are sometimes thought of as negotiable instruments, this is usually not the case.

Why do you need a promissory note and a loan agreement?

A loan agreement and promissory note is a formal document that outlines the terms of a contract between two parties. It includes things like interest rates, repayment plans and other aspects of the debt. A debt is one way to legally enforce a loan agreement with another party.

Is a loan agreement the same as a promissory note?

Unlike a promissory note, a loan agreement imposes obligations on both parties, so both the borrower and the lender must sign the agreement. A loan agreement should state for what purpose the loan will be used, and whether the borrower must provide compensation if the lender suffers losses.

Which is better promissory note or loan agreement?

If the sum is not huge and the relationship is trustworthy, it is preferable to go with a debtor to avoid potential legal issues. However, if the sum of money is huge and the relationship is not very confidential, be sure to use a secured loan agreement to ensure that your money is safe with the loan.

What is the difference between a business loan agreement and promissory note?

In other words, a promissory note is a document that shows your promise to repay a loan, but doesn’t provide much more information. A business loan agreement, on the other hand, contains all the details involved in the loan agreement between you and the lender.

Is a loan agreement a note?

Key takeaways. A loan note is a type of insurance contract that outlines the legal obligations of the lender and the borrower. A loan note is a legally binding agreement that includes all the terms of the loan, such as the payment schedule, due date, principal amount, interest rate and any prepayment penalties.

Is loan part of asset?

A loan may or may not be a current asset depending on several conditions. A current asset is any asset that will provide economic value for or within one year. When one party makes a loan, they receive cash, which is a current asset, but the loan amount is also added to the balance sheet as a liability.

Are loans considered assets? Is a loan an asset? A loan is an asset but consider that for reporting purposes that loan is also listed separately as a liability. Take that bank loan for the bike business.

Is a loan an asset or liability for a bank?

However, for a bank, a deposit is a liability on its balance sheet, while loans are assets because the bank pays deposit interest but earns interest income from loans.

Why loan is an asset for bank?

Loans, such as mortgages, are an important asset for banks because they generate revenue from the interest the customer pays on the loan.

What are liabilities for banks?

The main liabilities of the bank are its capital (including cash reserves and, often, subordinated debt) and deposits. The latter can be from domestic or foreign sources (companies and companies, private individuals, other banks and even governments).

What is the difference between a loan and a note?

The difference between a promissory note and a mortgage. The main difference between a promissory note and a mortgage is that a promissory note is the written agreement that contains the details of the mortgage loan, while a loan is a loan secured by property.

Do you need both a promissory note and a loan agreement? Often there is no legal requirement that a promise to pay be evidenced in a promissory note, nor is there a prohibition on including it in a loan or credit agreement. Although promissory notes are sometimes thought of as negotiable instruments, this is usually not the case.

Which is better promissory note or loan agreement?

If the sum is not huge and the relationship is trustworthy, it is preferable to go with a debtor to avoid potential legal issues. However, if the sum of money is huge and the relationship is not very confidential, be sure to use a secured loan agreement to ensure that your money is safe with the loan.

Does a promissory note mean you got the loan?

A promissory note is a written agreement between one party (you, the borrower) to repay a loan made by another party (often a bank or other financial institution).

Is a loan agreement a note?

Key takeaways. A loan note is a type of insurance contract that outlines the legal obligations of the lender and the borrower. A loan note is a legally binding agreement that includes all the terms of the loan, such as the payment schedule, due date, principal amount, interest rate and any prepayment penalties.

Sources :

Comments are closed.