Contents

Who owns the house in a mortgage?

While your home is the collateral for your mortgage, as long as the terms of that mortgage are met you, as the borrower, own your home.

Can you choose who owns your mortgage? No, borrowers do not choose their mortgage provider. If you are not satisfied with your servicer, you need to refinance to a new loan, using a lender that does not work with the servicer.

Does mortgage mean ownership?

A mortgage does not represent ownership. Instead, a mortgage is simply a promise to return a certain amount of money to the bank. This pledge is secured by an asset, usually the house you used the loan to buy.

Does a mortgage count as ownership?

In short, yes, you own your home but your mortgage lender has an interest in the property based on the documents that were signed and closed.

What does owning a mortgage mean?

A mortgage is an agreement between you and a lender that gives the lender the right to take your property if you default on the loan and interest. A home equity loan is used to purchase a home or to borrow money against the value of the home you own.

Who is the title holder on a mortgage?

When you buy a home, you become the title holder. Holding a home title gives you ownership of your property. There are many ways a person or group of people can hold a title.

Is the title the same as the mortgage?

To begin with, it is important to note the difference between a mortgage and a title. Property title and mortgage are not interchangeable terms. In short, a mortgage is an agreement to pay back the loan amount borrowed to buy a house. Title refers to the rights to own property.

Can someone be on the mortgage but not the title?

If your name is on the mortgage, but not the deed, this means that you are not the owner of the house. Instead, you are just a co-signer on the mortgage. Because your name is on the mortgage, you must pay the loan as if you were the owner of the house.

Who is the owner of a mortgage?

A mortgage holder, also referred to as a mortgage holder or note holder, is the entity that owns your loan. They have the legal right to execute a loan agreement, which consists of a loan deed and a security interest or deed of trust.

How do I know who holds my mortgage?

You can search for your mortgage holder online, call, or send a written request to your mortgage broker asking who owns your mortgage. The servicer is responsible for providing you, to the best of its knowledge, the name, address, and phone number of the person who owns your loan.

Is a mortgagor an owner?

A mortgage is a borrower’s property. They receive a loan from the mortgagee in exchange for a lien on the title deed, allowing the property to be used as collateral. The lender is expected to repay the loan in installments over the term of the loan.

What does holding a note mean?

hold note (plural hold group) (music) A note that remains constant in one part, while other parts move.

What does it mean to have a note on a home? A mortgage deed is a legal document that outlines all the terms of a mortgage between the borrower and the lending institution. It includes terms like: Total home loan amount. Payment amount. Whether monthly or monthly payments are required.

What does holding a loan mean?

A mortgage lien is a type of mortgage loan in which the seller acts as the lender and holds the title. The buyer pays a monthly fee directly to the owner.

What is a buy and hold loan?

Buy & Hold Loans Buy and hold loans are a short-term product aimed at real estate investors who are looking to buy and renovate a property before refinancing with a traditional long-term loan.

What does holding paper mean in real estate?

âHolding the documentâ usually refers to the seller’s option of financing the equivalent of a purchase-finance mortgage. When you as the seller accept a note secured by a mortgage or deed of trust on the property for all or part of the purchase price, you enter into a purchase mortgage agreement.

What does it mean for someone to carry the note?

“Owner will take note” means, simply put, the owner will finance your purchase and become the bank. Any loan he has in the house, it is his responsibility to pay, and you will pay it every month.

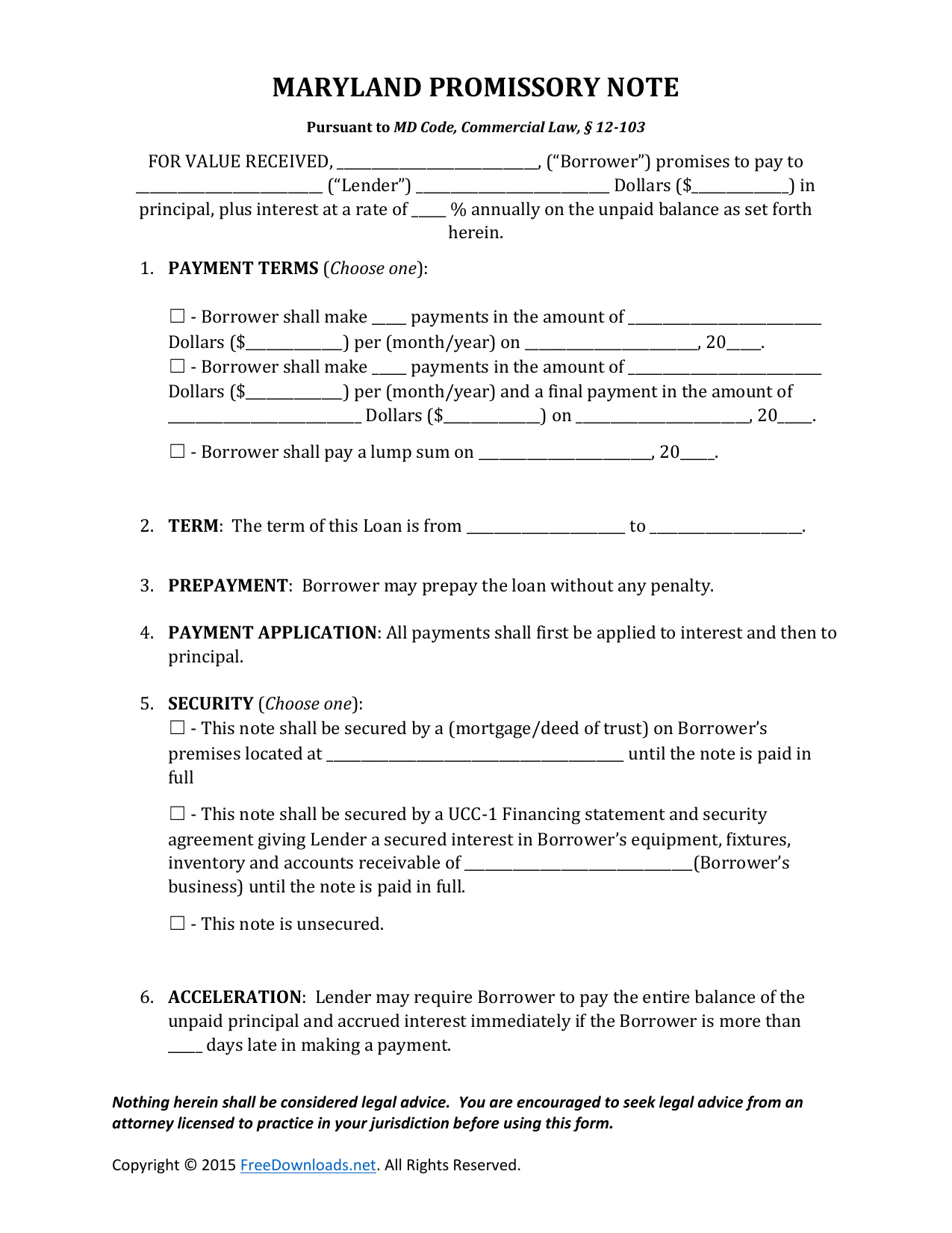

Who signs promissory note?

Only the borrower signs the loan document, while both the lender and the borrower sign the loan agreement. A signed document means that the borrower agrees to pay the loan.

What does it mean to hold paper in real estate?

âHolding the documentâ usually refers to the seller’s option of financing the equivalent of a purchase-finance mortgage. When you as the seller accept a note secured by a mortgage or deed of trust on the property for all or part of the purchase price, you enter into a purchase mortgage agreement.

What does it mean for a seller to hold paper?

Often referred to as “mortgage opportunities” or “holding papers,” personal finance is being offered as the easiest and fastest way to sell a home, especially in a volatile market. If you need the proceeds from the sale of one home to buy another, financing may not be the way to go.

What does carry the paper mean?

This type of financing is popular in the real estate industry as the owner agrees to “take the paper” for the buyer. It can be compared to taking out a mortgage. The bank that you make your monthly payments to is your true landlord. Your loan is actually a second mortgage.

Who executes a promissory note?

A promissory note is a legal document in which one party promises to pay a debt owed to another. Usually, the organization that processes the information is the organization that receives the money. He is also called a "maker" of notes. The credit union is known as the payer.

Who can enforce the agreement? To execute a certificate, the holder must give notice as required by the note. If the borrower does not pay on time, the holder of the note may file an action to recover payment.

Who is the person who signs a promissory note?

Only the borrower signs the loan document, while both the lender and the borrower sign the loan agreement. A signed document means that the borrower agrees to pay the loan.

Who is the bearer of a promissory note?

Bearer: the person who holds the certificate. It is also called a retainer. The carrier and the payee are usually the same person, but they can be different. Endorser: a person who approves a certificate.

What are the parties to a promissory note called?

While a promissory note consists of two parties (the payee and the payee), a check consists of three parties (the payee, the payee, and the bank from which the money is drawn).

Who makes payment of a promissory note?

A promissory note is a written promise to pay a debt. It is a financial instrument, in which one party (the maker or the issuer) promises in writing to pay a specified amount of money to the other party (the payee), either at a specified time, a specified future time or on demand special payer. the terms.

Who is the payee in a promissory note?

A promissory note is a legal document that obligates the signatory to pay a certain amount of money to another person on a certain date. The person who owes the money is called the payer, the maker, or the provider, or the advisor. The person to whom the money is owed is called the payer or the promisor.

Who makes payment of a promissory?

The drawer issues the certificate and promises to pay a certain amount to the payee. It is also called a promisor. A medical note can contain 2 or more parties.

Who is the bearer of a promissory note?

Bearer: the person who holds the certificate. It is also called a retainer. The carrier and the payee are usually the same person, but they can be different. Endorser: a person who approves a certificate.

Does a promissory note need to be signed by the lender?

Incomplete signature I repeat: Both parties must sign the agreement! This means both the lender and borrower must sign the original document (and any amended versions). Without the signature, the certificate has no legal standing to stand on.

What is required for a valid appointment statement? Notes must always be handwritten. It must include all the necessary information such as the legal names of the payer’s name and the name of the maker, the amount borrowed / to be paid, the full terms of the agreement and the full amount of liability, among other things.

Who is responsible for promissory note?

Entities of Promissory Note 1) Maker: This is the person who actually makes or executes the promissory note and pays the amount in it. 2) Payee: The person to whom the bill is to be paid is the payee. 3) Holder: The holder is the person who actually holds the note.

Who is primarily responsible for promissory notes?

Entities for Promissory Notes Whether endorsers or endorsers can be plural in some cases. 1) Maker: This is the person who actually makes or executes the promissory note and pays the amount in it. 2) Payee: The person to whom the bill is to be paid is the payee.

Who enforces a promissory note?

But what will happen when the person who signed the promise fails to fulfill this promise? If you are the debtor, executing the certificate is your responsibility. Read this article to learn how you can legally collect what you are owed.

Is a promissory note signed by the lender?

Only the borrower signs the loan document, while both the lender and the borrower sign the loan agreement. A signed document means that the borrower agrees to pay the loan.

What makes a promissory note invalid?

A promissory note may be invalid if it specifies A) the total amount owed by the borrower to the lender (at least the amount paid) or B) the amount of the payment and the date each installment is paid .

Will a promissory note stand up in court?

In general, as long as the certificate contains the amount of interest that is allowed by law, the signatures of both contracting parties, and they are within the statute of limitations, they can be proved in court.

Are promissory note must be signed by the?

A promissory note refers to a signed document containing a written promise to pay a stated amount by a specified date or on demand. The promisor should sign.

What signatures are needed on a promissory note?

These are the names and signatures of both parties (lender and borrower), the total amount of the loan owed, and the date the loan will be paid (or each installment).

Does a promissory note need to be signed?

Signature. Generally, a note does not need to be given notice. Typically, a legally enforceable bond must be signed by individuals and contains unconditional promises to pay a certain amount of money. Generally, they also state the due dates for payment and the agreed interest rate.

Sources :

Comments are closed.