Contents

How do you break a promissory note?

Circumstances for Issuing a Promissory Note The debt owed on a promissory note can be paid, or the note holder can forgive the debt even if it is not paid in full. In either case, the noteholder must sign a promissory note release.

Can you breach a promissory note? A promissory note is breached when payment due, or properly demanded, is not received in accordance with the terms of the note. If you wish to enforce a breached promissory note, you must follow the agreed terms when making a claim for payment.

What happens if you break a promissory note?

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. A person who defaults on a loan specified in a promissory note can lose an asset securing the loan, such as a home, or face other actions.

How legally binding is a promissory note?

Promissory notes are legally binding whether the note is secured by collateral or based solely on the promise of repayment. If you lend money to someone who defaults on a promissory note and doesn’t pay it back, you can legally own any property pledged by the individual as collateral.

Can a promissory note be broken?

A promissory note may be invalid if it does not include A) the total amount of money the borrower owes the lender (such as the amount of the note) or B) the number of payments due and the date each increment is due.

Will a promissory note hold up in court?

Generally, as long as the promissory note contains legally acceptable interest rates, is signed by both contracting parties, and is within the applicable Statute of Periods, it can be upheld in a court of law.

What is required for a promissory note to be valid?

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the interest rate, any collateral involved, and the repayment timeline. When the borrower signs this document, it becomes a legally binding contract.

Is a promissory note enforceable in court?

Promissory notes are legally binding whether the note is secured by collateral or based solely on the promise of repayment. If you lend money to someone who defaults on a promissory note and doesn’t pay it back, you can legally own any property pledged by the individual as collateral.

How do I get out of a promissory note?

Before a promissory note can be cancelled, the lender must agree to the terms under which it will be cancelled. A well-drafted and detailed promissory note can help the parties involved avoid disputes, misunderstandings and confusion in the future. When the promissory note is cancelled, the process is referred to as the release of the note.

What is the promised in a promissory note?

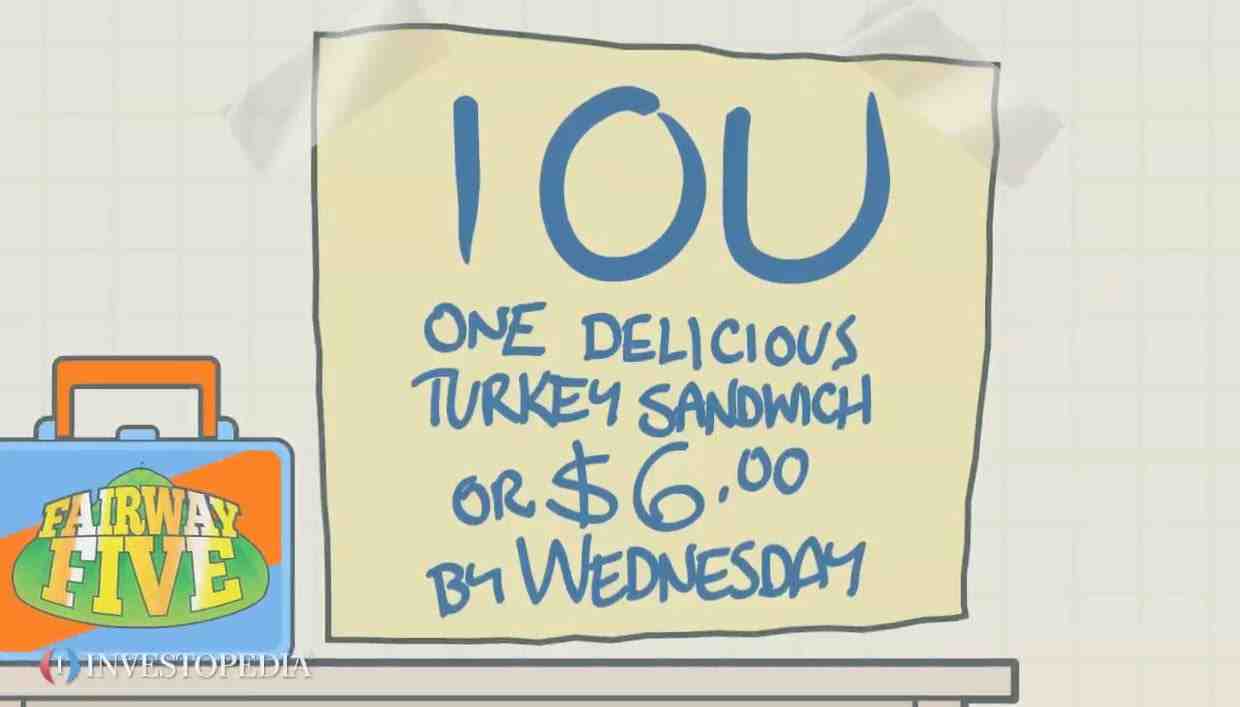

A promissory note is a financial instrument containing a written promise from one party (the issuer or maker of the note) to pay another party (the payee of the note) a specified sum of money, on demand or at a specified future date.

What are the disadvantages of a promissory note?

| Advantages of Promissory Note | Disadvantages of Promissory Note |

|---|---|

| Easy to create and write up | In some states, not notarizing a promissory note can lead to legal issues |

| Good for small amounts of money | For complex statements, a lawyer may be needed |

Can a promissory note be interest free?

If you decide to give the loan without charging any interest, be prepared to defend it to the IRS, because it is literally a gift in the eyes of the IRS. The IRS can "attribute" interest on your loan, whether or not you actually charged any interest, and you are required to report that notional interest as income.

Does your promissory note need to charge interest? The percentage of interest charged on the loan must be specified in a promissory note. Every loan should have a certain interest, even if it is between family members.

Can a promissory note have zero interest?

With few exceptions, you need to charge interest Unfortunately, the IRS may impute interest received by the seller, even if the parties agreed to zero interest or a rate below the IRS’s published rates.

Can a promissory note be interest free?

If you decide to give the loan without charging any interest, be prepared to defend it to the IRS, because it is literally a gift in the eyes of the IRS. The IRS can “press” interest on your loan, whether or not you actually charged any interest, and will require you to report that notional interest as income.

What is required for a valid promissory note?

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the interest rate, any collateral involved, and the repayment timeline. When the borrower signs this document, it becomes a legally binding contract.

What is required for a valid promissory note?

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the interest rate, any collateral involved, and the repayment timeline. When the borrower signs this document, it becomes a legally binding contract.

How do you verify a promissory note?

Most legitimate promissory notes can be easily verified by checking the SEC’s EDGAR database or by calling your state securities regulator, which you can find on the North American Association of Securities Administrators website.

How do you write a legally binding promissory note?

At its most basic, a promissory note should contain the following:

- Date.

- Name of lender and borrower.

- Amount of loan.

- Whether the loan is secured or unsecured. If it is secured by collateral: What is the collateral? …

- Payment amount and frequency.

- Payment due date.

- Whether the loan has a cosigner, and if so, who.

What makes a promissory note invalid?

A promissory note may be invalid if it does not include A) the total amount of money the borrower owes the lender (such as the amount of the note) or B) the number of payments due and the date each increment is due.

How long is a promissory note valid?

Depending on the state you live in, the statute of limitations for promissory notes can vary from three to 15 years. Once the statute of limitations has expired, a creditor can no longer file a lawsuit related to the unpaid promissory note.

Are promissory notes valid in court?

Generally, as long as the promissory note contains legally acceptable interest rates, is signed by both contracting parties, and is within the applicable Statute of Periods, it can be upheld in a court of law.

What happens when a promissory note is paid in full?

The borrower satisfies the loan by repaying the full amount owed on the loan. The lender will no longer be required to hold the promissory note.

Does a promissory note need to be repaid? What happens when a promissory note is not paid? Promissory notes are legally binding contracts. That means when you don’t pay back your loan, you could lose your collateral. If there is no collateral to secure the loan, the lender on the promissory note can take the borrower to court seeking repayment.

What voids a promissory note?

Even if you have the original note, it could be void if it was not written correctly. If the person you’re trying to collect from hasn’t signed it â and yes, this happens â the note is void. It could also be void if it fails some other law, for example, if it charges an illegal high rate of interest.

What makes a promissory note invalid?

A promissory note may be invalid if it does not include A) the total amount of money the borrower owes the lender (such as the amount of the note) or B) the number of payments due and the date each increment is due.

What is required for a valid promissory note?

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the interest rate, any collateral involved, and the repayment timeline. When the borrower signs this document, it becomes a legally binding contract.

How do you dissolve a promissory note?

Write a “Cancellation of Promissory Note” letter or have the lawyer write one for you. The note should include details of the original promissory note and should also indicate that the original promissory note has been canceled at the request of both parties. Ask the promisor to sign the document in the presence of a notary.

Do promissory notes hold up in court?

Generally, as long as the promissory note contains legally acceptable interest rates, is signed by both contracting parties, and is within the applicable Statute of Periods, it can be upheld in a court of law.

Can a promissory note be canceled?

Before a promissory note can be cancelled, the lender must agree to the terms under which it will be cancelled. A well-drafted and detailed promissory note can help the parties involved avoid disputes, misunderstandings and confusion in the future. When the promissory note is cancelled, the process is referred to as the release of the note.

What happens when a promissory note is paid off?

Once a note has been paid, it is time to tie up loose ends and release the parties from their obligations. A clean break will provide peace of mind, fulfill all obligations, and lead to an amicable conclusion. Discharge is the definitive end of the parties’ commitment under a note.

How do I show a promissory note is paid in full?

Add a signature next to the “paid in full” notation. The original lender must sign the promissory note and add a date next to the “paid in full” notation. The date the lender places on the promissory note should be the date the borrower made the last payment on the loan.

What is it called when you pay off a promissory note?

Once the promissory note debt has been satisfied, the promissory note holder should execute a promissory note release. Such a document serves as proof to the borrower that the debt has been paid. This is sometimes called a promissory note release.

WHO issues promissory note?

Promissory notes are debt instruments. They may be issued by financial institutions. However, they can also be issued by small companies or individuals. They enable a person or business to get financing without going through a bank.

Who owns the promissory note? Promissory notes are not the same as mortgages, but the two often go hand in hand when buying a home. The mortgage secures the promissory note with the title to the home.

Can anyone write a promissory note?

Signing and Storing a Promissory Note However, it is not necessary to use a lawyer for the loan to be valid. Once you draft the promissory note, it’s time for everyone to sign it: the lender, the borrower and the co-signer (if there is one).

How legal is a promissory note?

Promissory notes are legally binding whether the note is secured by collateral or based solely on the promise of repayment. If you lend money to someone who defaults on a promissory note and doesn’t pay it back, you can legally own any property pledged by the individual as collateral.

Who can write up a promissory note?

A promissory note is a contract that specifies the terms of a loan. It reduces misunderstandings and provides a legal remedy if the borrower defaults or the lender violates its rights. If you are receiving or lending money, you should consider having one—you can write one as a borrower or a lender.

Who can issue promissory note in India?

4[(2) Notwithstanding anything in the Negotiable Instruments Act, 1881, (26 of 1881) no person in 2[India] other than the Bank or, as expressly authorized by this Act, the Central Government, shall, no commitment. express note payable to the bearer of the instrument.]

What is a promissory note in Indian law?

A promissory note is an instrument, as defined under section 4 of the Negotiable Instruments Act of 1881, an instrument, made in writing, containing an unconditional promise signed by the maker, to pay a specified sum of money to one particular person. or by order of that particular person, or the …

Who can make a promissory note in India?

A promissory note is a legal and financial instrument written between three financing parties: the maker, the lender, and the payee/borrower.

Comments are closed.