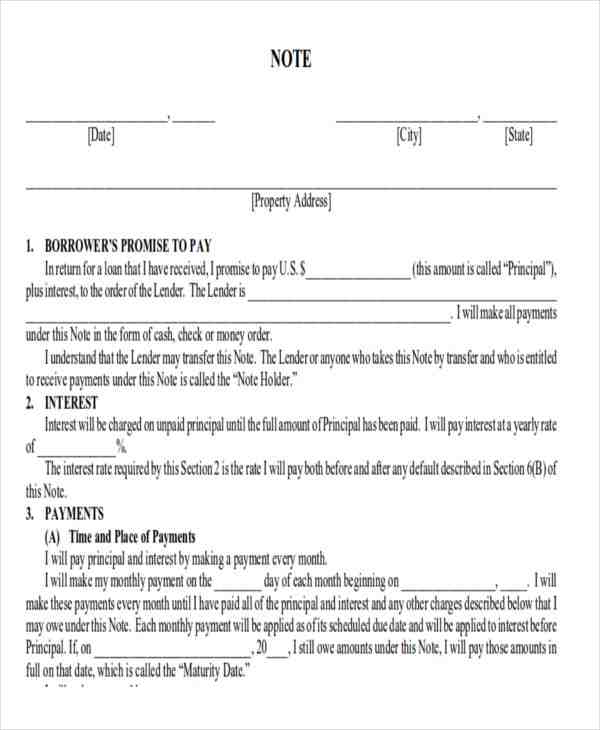

Promissory note: Your loan commitment It is also called a promissory note. And that’s another long document, 7 to 12 pages long. In addition to listing all the borrowers, it covers the following: The amount you owe, the principal.

Contents

Where is the Loan Note number?

Need help finding your credit memo number? To find your loan note number, look for the loan account number in the upper right corner on your last loan statement. The account number is followed by a dash followed by five digits. The last two digits of these five are the number of the loan note.

Is the loan number the same as the account number? Your Loan ID is a 3-digit number that identifies the type of loan (new vehicle, floating rate mortgage, line of credit, etc.). Note: Your loan ID is not an account number.

How many numbers is a loan number?

Your individual loan numbers, each with 16 digits, are not displayed in your online profile. However, both the account number and the loan number appear on your monthly statements.

How do I find my loan number?

How do I find my credit account number?

- Check your loan statement. …

- Log in to your bank’s website or app. …

- Call the bank’s toll-free customer service number. …

- Visit any branch of your bank.

How many digits is a home loan number?

Loan number Average of six to ten characters. This number is one of the most important information about the loan, distinguishing it from other loans.

What is a note number for loans united bank?

If you have a coupon booklet, you can also find your note number on the coupon, the 5-digit number after the account number.

What is the routing number for United Bank WV?

To get started, you need our clearing number (056004445) and an account number.

Can you pay a bank loan with a debit card?

Although the lending industry has been slower than others in accepting debit card payments, the practice is now mainstream among the country’s leading lenders. In a recent ACI survey of America’s top 20 lenders, 60 percent accept debit cards to pay off loans.

What is a note for a loan?

A credit note is a legally binding contract that includes all loan terms such as repayment schedule, maturity, principal, interest, and any prepayment penalties.

What does note mean in finance?

A promissory note, also known as a promissory note, is a legal debt instrument in which one party makes a written promise to pay a specified amount of money to the other party under certain conditions.

What is the difference between a note and a loan?

The difference between a promissory note and a mortgage. The main difference between a promissory note and a mortgage is that a promissory note is a written contract containing the details of the mortgage loan, while a mortgage is a loan secured by real estate.

How do I get my mortgage note?

To obtain a mortgage note, you must apply for a loan from your lender. Once approved, they will send you an official document setting out all the terms and conditions related to your mortgage.

Can you get a mortgage letter online? Mortgage Notes can be purchased through mortgage brokerages (you can find hundreds of them online). They can also be purchased in stocks of mortgage packages through real estate investment funds or other similar products.

Who holds the note to my mortgage?

When the borrower pays off the mortgage, the holder of the banknote hands the banknote to the borrower. This means that the home is theirs, free and transparent. If the borrower refinances the mortgage, the new mortgage pays off the original lender and a new note is created to be kept by that lender until the new mortgage is fully repaid.

Who keeps the original promissory note?

1. Keep the original promissory note. After executing the bill of exchange, the lender keeps the original of the bill of exchange. The promissory note includes the borrower’s signature.

What is the note on a mortgage?

A promissory note – also known as a promissory note or even a mortgage note – is a legal document that obliges you to pay your mortgage on an agreed date. The note also shows the terms of the loan agreement with your mortgage provider.

What is a current mortgage note?

A promissory note – also known as a promissory note or even a mortgage note – is a legal document that obliges you to pay your mortgage on an agreed date. The note also shows the terms of the loan agreement with your mortgage provider.

What else is a mortgage note called?

In the United States, a promissory note (also known as a mortgage note, the borrower) is a note secured by a specific mortgage.

How do I find my mortgage note?

The mortgage note is signed when you close your home and a copy can be obtained from your lender, broker or even the county registrar.

Can a mortgage note be signed?

So, by signing the promissory note, you promise to pay back the amount you borrowed, usually in the form of monthly installments. Signing up for a mortgage gives your lender a way to get your money back if you don’t make these payments – through repossession.

Is the mortgage letter a legal document? A mortgage note is a legal document that sets out all the terms of a mortgage loan between a borrower and his credit institution. It includes terms such as: The total amount of your home loan. The amount of the advance payment.

Who signs a mortgage note?

Who signs the mortgage note? Since the mortgage book specifies the amount of debt, the interest rate and obliges the borrower to repay it personally, the borrower signs a mortgage note.

What is a mortgage signatory?

The Mortgage Cosigner takes responsibility for ensuring the mortgage payment. Some borrowers need the help of a more financially secure cosigner to qualify for a mortgage, and those who help should understand exactly what they are getting into.

Who executes a note and mortgage?

Borrowers execute both a promissory note and a mortgage to secure the lender’s interest in the loan. While both bank notes and mortgages are critical to the loan package, each serves a different purpose. A memo is a document that serves as an obligation of borrowers to pay.

Can a mortgage note be signed electronically?

Yes, electronic signatures are generally legal and enforceable under the World and Domestic Trade Electronic Signatures (E-Sign) Act governing consumer and commercial transactions and state regulations adopted under the Uniform Electronic Transactions Act (UETA) or similar electronic signature by state law , which …

What is an e signing in a mortgage transaction?

eClosings uses a secure web portal that allows borrowers and lenders to electronically sign property transaction closure documents. Digital signatures can take many forms. Examples of acceptable electronic signatures include: Entering your full name in the signature space.

What mortgage documents require a wet signature?

For example, wet ink signatures should be required for promissory notes and notarized documents. In addition, wet ink signatures should also be required for security documents such as mortgages, deeds of trust and other contracts that are enhanced by filing with government registries.

Can a mortgage be signed?

Signing a loan jointly is not just a character reference – it’s a legally binding contract. This means that if you are a co-signatory, the lender may come for you to make a payment if the primary signatory defaults on the mortgage.

Can mortgage documents be signed electronically?

Yes. Loans closed through the online remote notarization process may include either wet ink signed promissory notes (ie Non-e-Mortgage) or electronically signed notes (ie e-Mortgage). Sellers can only deliver loans with electronically signed notes if they are approved to deliver e-mortgage.

Can a mortgage be signed over?

In most cases, a mortgage is not transferable from one borrower to another. This is because most lenders and loan types do not allow another borrower to take over the existing mortgage payments.

What is the difference between a loan and a loan note?

It is a debt repayment agreement between the parties in the future. However, loan memo instruments are usually more complex than a regular loan agreement and can involve multiple lenders (although they can be between two parties) and often contain more complex repayment terms.

What is the better promissory note or loan agreement? If the sum is not large and the relationship is trustworthy, a promissory note is preferred to avoid potential legal problems. However, if the sum of money is huge and the relationship is not completely trustworthy, use a secured loan agreement to make sure your money is safe for the borrower.

What is a loan note?

A credit note is a legally binding contract that includes all loan terms such as repayment schedule, maturity, principal, interest, and any prepayment penalties.

Are loan notes equity or debt?

A credit note is a financial instrument that in the simplest terms affirms a debt between a borrower (commonly known as the issuer) and one or more lenders (commonly referred to as loan note holders). It is a debt repayment agreement between the parties in the future.

What is the difference between a note and a loan?

The difference between a promissory note and a mortgage. The main difference between a promissory note and a mortgage is that a promissory note is a written contract containing the details of the mortgage loan, while a mortgage is a loan secured by real estate.

Is there a difference between a loan and a note?

Both loan agreements and promissory notes are legally binding – and enforceable – documents that set out the conditions for paying off your debts. However, the loan agreement usually contains more detailed and stringent terms, with greater obligations and restrictions placed on the borrower.

Is a note a loan?

Key Takeaways. A memo is a legal document that represents a loan made by the issuer to a creditor or investor. The bonds entail a repayment of the principal amount borrowed as well as any predetermined interest payments. The US government issues T-notes to raise money to pay for infrastructure.

Do you need both a promissory note and a loan agreement?

Often there is no legal requirement that a promise to pay should be evidenced by a promissory note, nor is there any prohibition on including it in a loan or credit agreement. While promissory notes are sometimes considered negotiable instruments, this is usually not the case.

Sources :

Comments are closed.