Contents

How does a promissory note work?

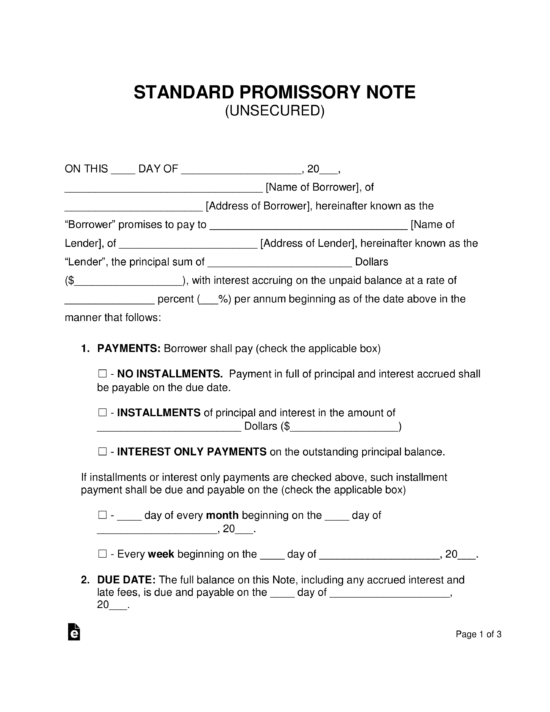

What does a promissory note contain? A form of debt instrument, a promissory note represents a written promise by the issuer to pay another party. A promissory note will include the terms agreed upon between the two parties, such as the maturity date, principal, interest, and signature of the issuer.

What makes a promissory note invalid? A promissory note may be invalid if it excludes A) the total amount of money the borrower owes the lender (aka the note amount) or B) the number of payments due and the due date of each increment.

How enforceable is a promissory note?

Promissory notes are legally binding whether the promissory note is secured by collateral or based solely on the promise of repayment. If you lend money to someone who defaults on a promissory note and defaults, you can legally own any property that person has pledged as collateral.

Will a promissory note stand up in court?

In general, as long as the promissory note contains legally acceptable interest rates, the signatures of both contracting parties, and are within the applicable prescription, can be confirmed in court.

Are promissory note legally binding?

A promissory note is a written agreement to pay someone, basically an IOU. But it is not something to be taken lightly. “It’s a legally binding written document that makes a promise to repay money,” says Andrea Wheeler, business attorney and owner of Wheeler Legal PLLC in Florida.

What happens if a promissory note is not paid?

What happens when a promissory note is not paid? Promissory notes are legally binding documents. Someone who defaults on a loan itemized on a promissory note can lose an asset securing the loan, such as a home, or face other actions.

When a promissory note is executed it becomes?

A promissory note or letter of payment is a legal instrument detailing a contractual agreement between two parties. When the parties agree and sign the promissory note, it becomes a legally binding instrument that binds both parties to perform according to their agreement.

Is there a time limit on a promissory note?

Promissory notes have a limitation period. Depending on the US state you live in, a written loan agreement can expire 3–15 years after it is created.

What signatures are needed on a promissory note?

These are the names and signatures of both parties (lender and borrower), the total amount of the loan owed, and the due date of the loan payment (or each payment). Without a notary public signature, your promissory note is still valid with these items.

What is required to have a valid voucher? A promissory note must always be written by hand. It must include all the mandatory elements such as the legal names of the beneficiary and the name of the manufacturer, the amount lent/to be repaid, the full terms of the contract and the total amount of the liability, among other elements.

Does a promissory note need two signatures?

I REPEAT: Both parties must sign the promissory note! This means that both the lender and the borrower must sign the original document (as well as the amended versions). Without the signatures, the promissory note has no legal basis to stand on.

Does a promissory note have to be witnessed?

A valid promissory note only needs the signatures of the parties involved in the agreement, without the need for recognition or to be witnessed by a notary public to be legitimate.

Should a promissory note be signed by both parties?

A promissory note is a written promise to pay within a specific time period. This type of document enforces the borrower’s promise to repay the lender within a specified time period and both parties must sign the document.

Does promissory note need to be signed?

For the promissory note to be valid, the borrower must sign it. The lender may require the borrower to sign this document in front of a notary public to ensure the signature.

What happens if a promissory note is not signed?

Incomplete signatures This means that both the lender and the borrower must sign the original document (as well as amended versions). Without the signatures, the promissory note has no legal basis to stand on.

What makes a promissory note valid?

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the interest rate, any collateral involved, and the repayment term. When this document is signed by the borrower, it becomes a legally binding contract.

Should a promissory note be signed by both parties?

A promissory note is a written promise to pay within a specific time period. This type of document enforces the borrower’s promise to repay the lender within a specified time period and both parties must sign the document.

Does a loan agreement have to be signed by both parties?

Usually, only the borrower signs an IOU and a promissory note, although they can be signed by both parties. A loan agreement is a single document that contains all the terms of the loan and is signed by both parties.

What makes a promissory note invalid?

A promissory note is a contract, a binding agreement whereby someone will pay a sum of money to your business. However, in some circumstances – if the note has been altered, not written correctly, or if you have no right to claim the debt – then the contract becomes void.

What is a legal promissory note?

An unconditional promise to pay a specified amount of money to a designated person or noteholder, or to deposit such money as directed by such persons. A promissory note must be in writing and signed by the promisor. business law

What makes a valid promissory note? A promissory note must include the date of the loan, the dollar amount, the names of both parties, the interest rate, any collateral involved, and the repayment term. When this document is signed by the borrower, it becomes a legally binding contract.

Will a promissory note stand up in court?

In general, as long as the promissory note contains legally acceptable interest rates, the signatures of both contracting parties, and are within the applicable prescription, can be confirmed in court.

How can a promissory note be enforced?

To enforce a promissory note, the holder must give notice as required on the promissory note. If the borrower fails to make the payment on time, the noteholder may file an action to recover the payment.

Is a promissory note legally binding?

A promissory note is a written agreement to pay someone, basically an IOU. But it is not something to be taken lightly. “It’s a legally binding written document that makes a promise to repay money,” says Andrea Wheeler, business attorney and owner of Wheeler Legal PLLC in Florida.

What are the three types of promissory notes?

Types of promissory notes Informal or personal: this type of promissory note can be from one friend or family member to another. Commercial: These notes are more formal. They explain the specific conditions of a loan. Real Estate: This promissory note accompanies a mortgage or other agreement to purchase real estate.

What are three characteristics of a promissory note?

Features of promissory note There must be a clear and unconditional promise to pay a specified amount to a specified person or on demand. It must be drawn and duly signed by the manufacturer. It must be properly sealed. The amount to be paid must be true, stated in both figures and words.

What type of asset is a promissory note?

Summary. A note receivable is also known as a promissory note. When the subscription is due in less than a year, it is considered a current asset on the balance sheet of the company to which it is owed. If its maturity is more than one year in the future, it is considered a non-current asset.

Is a promissory note a legal document?

A promissory note is a written agreement to pay someone, basically an IOU. But it is not something to be taken lightly. “It’s a legally binding written document that makes a promise to repay money,” says Andrea Wheeler, business attorney and owner of Wheeler Legal PLLC in Florida.

Does a promissory note hold up in court?

Promissory notes are legally binding whether the promissory note is secured by collateral or based solely on the promise of repayment. If you lend money to someone who defaults on a promissory note and defaults, you can legally own any property that person has pledged as collateral.

What happens if you break a promissory note?

What happens when a promissory note is not paid? Promissory notes are legally binding documents. Someone who defaults on a loan itemized on a promissory note can lose an asset securing the loan, such as a home, or face other actions.

Should a promissory note be signed by both parties?

A promissory note is a written promise to pay within a specific time period. This type of document enforces the borrower’s promise to repay the lender within a specified time period and both parties must sign the document.

Does a promissory note need two signatures? I REPEAT: Both parties must sign the promissory note! This means that both the lender and the borrower must sign the original document (as well as the amended versions). Without the signatures, the promissory note has no legal basis to stand on.

What makes a promissory note invalid?

A promissory note is a contract, a binding agreement whereby someone will pay a sum of money to your business. However, in some circumstances – if the note has been altered, not written correctly, or if you have no right to claim the debt – then the contract becomes void.

What voids a promissory note?

Even if you have the original note, it may be void if it was not written correctly. If the person you’re trying to pick up didn’t sign it – and yes, that happens – the note is void. It can also be void if you broke some other law, for example, if you were charging an illegally high interest rate.

Can a promissory note be challenged?

If you have a problem with an unpaid personal note and can’t come to an alternative arrangement with your friend or family member who borrowed the money, legal intervention may be your only option. A local debt collection attorney can help you attempt debt collection and file a lawsuit, if necessary.

Does a loan agreement have to be signed by both parties?

Usually, only the borrower signs an IOU and a promissory note, although they can be signed by both parties. A loan agreement is a single document that contains all the terms of the loan and is signed by both parties.

What is a valid loan agreement?

Loan agreements usually include covenants, value of the collateral involved, guarantees, interest rate terms and the duration over which repayment must be made. Default terms should be clearly spelled out to avoid confusion or possible legal action.

Does a loan agreement have to be signed?

Whether a person takes out a personal loan from a bank or borrows money to buy a property from a real estate lender, a loan agreement must be signed in advance.

Sources :

Comments are closed.